NEWS AND INSIGHTS

Featured News

GCG Advises Variation Reduction Solutions, Inc. on its Acquisition of Inos from Grenzebach Maschinenbau GmbH

GCG Advises Variation Reduction Solutions, Inc. on its Acquisition of Inos from Grenzebach Maschinenbau GmbH

Latest News

GCG is pleased to announce its role as the exclusive financial advisor to Variation Reduction Solutions, Inc. on its acquisition of Inos Automationssoftware GmbH and Inos Hellas S.A. from Grenzebach Maschinenbau GmbH.

Evaluating Aesthetics: MedSpa Growth and Strategic Consolidation

Evaluating Aesthetics: MedSpa Growth and Strategic Consolidation

Perspectives

This report explores the key drivers behind the MedSpa industry's sustained growth, recent innovations, and the current M&A landscape and outlook.

RFK Is Coming For Your Label

RFK Is Coming For Your Label

Perspectives

RFK well-publicized crusade against processed foods, synthetic additives, and industry influence has industry executives bracing for a fundamental regulatory shift.

Q4 2024 Managed IT Services and MSP Market Update

Q4 2024 Managed IT Services and MSP Market Update

Industry Update

GCG’s Managed IT Services and MSP Market Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Consumer Healthcare Global Conversation 2.0

Consumer Healthcare Global Conversation 2.0

Perspectives

The Consumer Healthcare industry has a long and focused history of aligning brand marketing with outside, mission-based causes. These partnerships are designed to fund healthcare related issues while at the same time personalizing the brand with their targeted consumer.

Q4 2024 Healthcare Industry Update

Q4 2024 Healthcare Industry Update

Industry Update

GCG’s Healthcare Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q4 2024 Aerospace & Defense Industry Update

Q4 2024 Aerospace & Defense Industry Update

Industry Update

GCG’s A&D Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q4 2024 Automotive/AutoTech Industry Update

Q4 2024 Automotive/AutoTech Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q4 2024 Food & Beverage Industry Update

Q4 2024 Food & Beverage Industry Update

Industry Update

GCG’s Food & Beverage Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Q4 2024 Middle Market M&A Update

Q4 2024 Middle Market M&A Update

Industry Update

GCG’s Middle Market M&A Update provides an overview of the latest trends in the market, including the recent performance of select sectors and the state of the middle market M&A environment.

U.S. Seafood Update: Fresh and Thriving

U.S. Seafood Update: Fresh and Thriving

Perspectives

This report walks through current trends and major industry players in the seafood market.

Q4 2024 Middle Market Private Equity Update

Q4 2024 Middle Market Private Equity Update

Industry Update

GCG’s Q4 2023 Middle Market Private Equity Update provides an overview of the latest trends in the market.

Q4 2024 Automotive Aftermarket Industry Update

Q4 2024 Automotive Aftermarket Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q4 2024 Consumer Discretionary Industry Update

Q4 2024 Consumer Discretionary Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q4 2024 Business Services Industry Update

Q4 2024 Business Services Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

National Retail Federation (NRF) 2025

National Retail Federation (NRF) 2025

Perspectives

The report highlights 28 standout companies at NRF 2025 with unique thoughts and interesting takeaways on their retail strategies going forward.

U.S. Jewelry Industry: Still Sparkling

U.S. Jewelry Industry: Still Sparkling

Perspectives

This report walks through current trends, segmentation of brands, sustainability trends, the rise of lab-grown diamonds, and the complicated diamond supply chain.

Defending Private Equity: The Scapegoat of the Broken U.S. Healthcare System

Defending Private Equity: The Scapegoat of the Broken U.S. Healthcare System

Perspectives

By understanding the multifaceted nature of healthcare issues and acknowledging the contributions of private equity, we can work towards a more effective and equitable healthcare system for all.

GCG Advises on the Sale of Alline Salon Group to Regis Corporation

GCG Advises on the Sale of Alline Salon Group to Regis Corporation

Latest News

GCG is pleased to announce its role as the exclusive financial advisor to Alline Salon Group on its sale to Regis Corporation.

US Frozen Pizza Industry: The Pie Keeps Growing

US Frozen Pizza Industry: The Pie Keeps Growing

Perspectives

The frozen pizza market brought in approximately $7.0 billion in sales in 2024 and is continuing to grow as nearly 20% of Americans purchase frozen pizza monthly.

Q3 2024 Automotive/AutoTech Industry Update

Q3 2024 Automotive/AutoTech Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

GCG Advises on the sale of Eos Business Surveillance Solutions to Security 101

GCG Advises on the sale of Eos Business Surveillance Solutions to Security 101

Latest News

GCG is pleased to announce its role as the exclusive financial advisor to Eos Business Surveillance Solutions on its sale to Security 101, a portfolio company of Gemspring Capital.

Q3 2024 Middle Market M&A Update

Q3 2024 Middle Market M&A Update

Industry Update

GCG’s Middle Market M&A Update provides an overview of the latest trends in the market, including the recent performance of select sectors and the state of the middle market M&A environment.

Private Equity Buyers Seeking Founder-Owned Companies

Private Equity Buyers Seeking Founder-Owned Companies

Perspectives

At Greenwich Capital Group (GCG) we have made a career over the past 10 years focusing on and specializing in helping founder-led companies optimize their liquidity strategy.

Q3 2024 Consumer Discretionary Industry Update

Q3 2024 Consumer Discretionary Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q3 2024 Automotive Aftermarket Industry Update

Q3 2024 Automotive Aftermarket Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Impact of the Election Results on the M&A Market

Impact of the Election Results on the M&A Market

Perspectives

GCG discusses several factors driving M&A activity following Donald Trump’s recent victory in the US presidential election.

From Snow to Soil: M&A Trends in Seasonal Service Industries

From Snow to Soil: M&A Trends in Seasonal Service Industries

Perspectives

Can companies in the landscaping and snow removal industries co-exist and complement each other? Or are the business fundamentals just too incongruent?

Q3 2024 Aerospace & Defense Industry Update

Q3 2024 Aerospace & Defense Industry Update

Industry Update

GCG’s A&D Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q3 2024 Food & Beverage Industry Update

Q3 2024 Food & Beverage Industry Update

Industry Update

GCG’s Food & Beverage Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

GCG Expands to New York

GCG Expands to New York

Latest News

GCG is excited to announce its expansion into the New York market, led by Managing Directors Alex Chefetz and Greg Urban.

GCG Advises on the Sale of Axium Foods to Cheeze Kurls

GCG Advises on the Sale of Axium Foods to Cheeze Kurls

Latest News

GCG is pleased to announce its role as the exclusive financial advisor to Axium Foods on its sale to Cheeze Kurls a portfolio company of Nexus Capital Management.

The Value Wars

The Value Wars

Perspectives

The fast-food industry is facing a new reality where price-conscious diners are reconsidering their options.

GCG Advises on the Recapitalization of Miller Industries with Tower Arch Capital

GCG Advises on the Recapitalization of Miller Industries with Tower Arch Capital

Latest News

GCG is pleased to announce its role as the exclusive financial advisor to the Miller family in the recapitalization of Miller Industries with Tower Arch Capital.

Q2 2024 E-Commerce Industry Update

Q2 2024 E-Commerce Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

GCG Advises on the Sale of Master Wireless Holdings to Alliance Mobile

GCG Advises on the Sale of Master Wireless Holdings to Alliance Mobile

Latest News

GCG is pleased to announce its role as the exclusive financial advisor to Master Wireless Holdings on its sale of 33 stores in Michigan and Wisconsin to Alliance Mobile Inc, a portfolio company of Centre Partners Management.

Q2 2024 Business Services Industry Update

Q2 2024 Business Services Industry Update

Industry Update

GCG’s Q2 2024 Business Services Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Joe Schmitt Named Office Managing Partner for Nashville

Joe Schmitt Named Office Managing Partner for Nashville

Latest News

GCG is excited to announce that Co-founder and Managing Director, Joe Schmitt, has been named office managing partner for Nashville!

The Revolution of Artificial Intelligence and Digital Technologies in the Food & Beverage Industry

The Revolution of Artificial Intelligence and Digital Technologies in the Food & Beverage Industry

Perspectives

Although artificial intelligence has been around for some time, its adoption is now skyrocketing, particularly in the food and beverage industry.

Space and Missile Defense: Hypersonics, Data/AI, and Cybersecurity

Space and Missile Defense: Hypersonics, Data/AI, and Cybersecurity

Perspectives

This paper summarizes key findings regarding hypersonic weapons, advancements in data analytics and artificial intelligence (AI), and the increasing requirement for advanced cybersecurity.

Q2 2024 Food & Beverage Industry Update

Q2 2024 Food & Beverage Industry Update

Industry Update

GCG’s Food & Beverage Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Working Ownership

Working Ownership

Perspectives

This article discusses the history, process, and examples of employing a fully distributed ownership plan for all employees.

Q2 2024 Healthcare Industry Update

Q2 2024 Healthcare Industry Update

Industry Update

GCG’s Healthcare Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q2 2024 AdTech and Marketing Services Industry Update

Q2 2024 AdTech and Marketing Services Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q2 2024 Aerospace & Defense Industry Update

Q2 2024 Aerospace & Defense Industry Update

Industry Update

GCG’s A&D Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q2 2024 Auto & AutoTech Industry Update

Q2 2024 Auto & AutoTech Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

GCG Advises on the Sale of Alpha Metalcraft Group to Industrial Growth Partners

GCG Advises on the Sale of Alpha Metalcraft Group to Industrial Growth Partners

Latest News

GCG is pleased to announce its role as the exclusive investment banker to Alpha Metalcraft Group on its sale to Industrial Growth Partners.

The Evolving Landscape of Private Equity Investments in Franchising

The Evolving Landscape of Private Equity Investments in Franchising

Perspectives

This article explores the evolving interest in franchisees, spotlighting specific funds and transactions that underscore this trend, attributes making franchisees attractive to PE firms, and the inherent risks and challenges.

Q2 2024 Middle Market M&A Update

Q2 2024 Middle Market M&A Update

Industry Update

GCG’s Middle Market M&A Update provides an overview of the latest trends in the market, including the recent performance of select sectors and the state of the middle market M&A environment.

Navigating the Compliance and Regulatory Landscape in Performance Marketing

Navigating the Compliance and Regulatory Landscape in Performance Marketing

Perspectives

This article outlines key compliance and regulatory considerations as well as ways to navigate the compliance and regulatory landscape in the ever-evolving field of performance marketing.

M&A Trends in the Fiber Broadband Industry

M&A Trends in the Fiber Broadband Industry

Perspectives

The fiber broadband network industry is experiencing significant growth, driven by escalating demand for high-speed internet and the increasing penetration of artificial intelligence applications.

GCG Advises on the sale of TopFlite Components to kSARIA

GCG Advises on the sale of TopFlite Components to kSARIA

Latest News

Greenwich Capital Group is pleased to announce its role as the exclusive financial advisor to TopFlite Components on its sale to kSARIA

Innovation in Natural Food & Beverage Products

Innovation in Natural Food & Beverage Products

Perspectives

In line with the growth, maturation, and mainstreaming of the natural products space (primarily F&B and Health & Wellness), innovation and M&A have been accelerated.

Cautiously Optimistic: 10 Trends from Summer Fancy Foods Show 2024

Cautiously Optimistic: 10 Trends from Summer Fancy Foods Show 2024

Perspectives

The overall mood at this year’s SFA – Summer Fancy Food Show at the Jacob Javits Convention Center in NYC was cautiously optimistic.

Navigating a Surge in Demand: Assessing What the Ukraine Conflict Means for U.S. Defense Companies and the Impact on M&A

Navigating a Surge in Demand: Assessing What the Ukraine Conflict Means for U.S. Defense Companies and the Impact on M&A

Perspectives

A rundown of the multifaceted impact of the Ukraine conflict on the U.S. defense industry, including considerations related to M&A activity.

Ozempic: The Magic Injection

Ozempic: The Magic Injection

Perspectives

Ozempic, originally a diabetes drug turned weight loss treatment, has quickly become a major industry force, challenging weight management, food companies, and QSR sectors, with potential broader applications for various addictions that could lead to significant economic impacts.

Q1 2024 AdTech and Marketing Services Industry Update

Q1 2024 AdTech and Marketing Services Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Fueling the Future: Investing in Global Nutrition Initiatives

Fueling the Future: Investing in Global Nutrition Initiatives

Perspectives

Today, difference-making consumer health brands have evolved their brand-consumer alignment: a strategic partnership model of non-governmental organizations working with private companies to differentiate consumer resonance, better engage/retain employees, and create more awareness.

Q1 2024 Middle Market M&A Update

Q1 2024 Middle Market M&A Update

Industry Update

GCG’s Middle Market M&A Update provides an overview of the latest trends in the market, including the recent performance of select sectors and the state of the middle market M&A environment.

Q1 2024 Auto & AutoTech Industry Update

Q1 2024 Auto & AutoTech Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Customer Data Platforms: A Game-Changer for Auto Dealership Marketing

Customer Data Platforms: A Game-Changer for Auto Dealership Marketing

Perspectives

In the fiercely competitive automotive industry, Customer Data Platforms have emerged as a powerful tool in the pursuit of innovation, enabling dealerships to revolutionize their marketing strategies and drive business growth.

Q1 2024 Business Services Industry Update

Q1 2024 Business Services Industry Update

Industry Update

GCG’s Q1 2024 Business Services Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Q1 2024 E-Commerce Industry Update

Q1 2024 E-Commerce Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q1 2024 Aerospace & Defense Industry Update

Q1 2024 Aerospace & Defense Industry Update

Industry Update

GCG’s A&D Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q1 2024 Healthcare Industry Update

Q1 2024 Healthcare Industry Update

Industry Update

GCG’s Healthcare Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q1 2024 Food & Beverage Industry Update

Q1 2024 Food & Beverage Industry Update

Industry Update

GCG’s Food & Beverage Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

GCG Advises on the sale of Venshure Test Services to AB Dynamics

GCG Advises on the sale of Venshure Test Services to AB Dynamics

Latest News

Greenwich Capital Group is pleased to announce its role as the exclusive financial advisor to Venshure Test Services on its sale to AB Dynamics plc.

Top 10 Trends from Natural Foods Expo West 2024

Top 10 Trends from Natural Foods Expo West 2024

Perspectives

Top 10 Trends from Natural Foods Expo West 2024

Q4 2023 E-Commerce Industry Update

Q4 2023 E-Commerce Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

ERP Trends to Watch in 2024

ERP Trends to Watch in 2024

Perspectives

The growth of cloud-based ERP (Enterprise Resource Planning) systems has been exponential in recent years, revolutionizing the way businesses manage their operations.

Q4 2023 AdTech and Marketing Services Industry Update

Q4 2023 AdTech and Marketing Services Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q4 2023 Food & Beverage Industry Update

Q4 2023 Food & Beverage Industry Update

Industry Update

GCG’s Food & Beverage Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

GCG Advises on the sale of Midwest Glass Fabricators to Oldcastle BuildingEnvelope®

GCG Advises on the sale of Midwest Glass Fabricators to Oldcastle BuildingEnvelope®

Latest News

Greenwich Capital Group is pleased to announce its role as the exclusive financial advisor to Midwest Glass Fabricators, Inc. on its sale to Oldcastle BuildingEnvelope, Inc.

Q4 2023 Business Services Industry Update

Q4 2023 Business Services Industry Update

Industry Update

GCG’s Q4 2023 Business Services Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Q4 2023 Middle Market M&A Update

Q4 2023 Middle Market M&A Update

Industry Update

GCG’s Middle Market M&A Update provides an overview of the latest trends in the market, including the recent performance of select sectors and the state of the middle market M&A environment.

Q4 2023 Middle Market Private Equity Update

Q4 2023 Middle Market Private Equity Update

Industry Update

GCG’s Q4 2023 Middle Market Private Equity Update provides an overview of the latest trends in the market.

Q4 2023 Auto & AutoTech Industry Update

Q4 2023 Auto & AutoTech Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

February 2024 Food Industry Deal Dish

February 2024 Food Industry Deal Dish

Industry Update

Greenwich Capital Group's pulse on the current state of the Food & Beverage industry

M&A Demand for Managed Service Providers in 2024

M&A Demand for Managed Service Providers in 2024

Perspectives

As the Managed Service Provider industry continues to grow, GCG discusses the trends driving M&A demand for MSPs.

Q4 2023 Healthcare Industry Update

Q4 2023 Healthcare Industry Update

Industry Update

GCG’s Healthcare Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q4 2023 Aerospace & Defense Industry Update

Q4 2023 Aerospace & Defense Industry Update

Industry Update

GCG’s A&D Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

How TikTok is Disrupting the E-Commerce Landscape for Food & Beverage Companies

How TikTok is Disrupting the E-Commerce Landscape for Food & Beverage Companies

Perspectives

How TikTok is Disrupting the E-Commerce Landscape for Food & Beverage Companies

Q3 2023 Business Services Industry Update

Q3 2023 Business Services Industry Update

Industry Update

GCG’s Q3 2023 Business Services Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Q3 2023 AdTech and Marketing Services Industry Update

Q3 2023 AdTech and Marketing Services Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q3 2023 Auto & AutoTech Industry Update

Q3 2023 Auto & AutoTech Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q3 2023 Healthcare Industry Update

Q3 2023 Healthcare Industry Update

Industry Update

GCG’s Q3 2023 Healthcare Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q3 2023 Food & Beverage Industry Update

Q3 2023 Food & Beverage Industry Update

Industry Update

GCG’s Food & Beverage Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Q3 2023 E-Commerce Industry Update

Q3 2023 E-Commerce Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q3 2023 Middle Market M&A Update

Q3 2023 Middle Market M&A Update

Industry Update

GCG’s Middle Market M&A Update provides an overview of the latest trends in the market, including the recent performance of select sectors and the state of the middle market M&A environment.

Q3 2023 Aerospace & Defense Industry Update

Q3 2023 Aerospace & Defense Industry Update

Industry Update

GCG’s Q3 2023 A&D Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

The Future ERP: Strategic M&A Within Partner Ecosystems

The Future ERP: Strategic M&A Within Partner Ecosystems

Perspectives

The world of Enterprise Resource Planning systems is undergoing a significant transformation.

GCG Advises on the sale of Woodharbor Molding & Millworks to WF Cabinetry Group

GCG Advises on the sale of Woodharbor Molding & Millworks to WF Cabinetry Group

Latest News

Greenwich Capital Group is pleased to announce its role as the exclusive financial advisor to Woodharbor Molding & Millworks, Inc. on its sale to WF Cabinetry Group, a portfolio company of HCI Equity Partners.

GCG Advises Longstreth Sporting Goods on its Sale to Roebling Capital Partners

GCG Advises Longstreth Sporting Goods on its Sale to Roebling Capital Partners

Latest News

Greenwich Capital Group is pleased to announce its role as the exclusive financial advisor to Longstreth Sporting Goods, LLC on its sale to Roebling Capital Partners.

An Update to the Inflation Reduction Act

An Update to the Inflation Reduction Act

Perspectives

A year has passed since the Inflation Reduction Act was signed into law on August 16, 2022. There is significant momentum to bolster U.S. competitiveness in disruptive technologies such as renewable energy, batteries, and electric vehicles.

Q2 2023 Middle Market Private Equity Update

Q2 2023 Middle Market Private Equity Update

Industry Update

GCG’s Q2 2023 Middle Market Private Equity Update provides an overview of the latest trends in the market.

Q2 2023 Healthcare Industry Update

Q2 2023 Healthcare Industry Update

Industry Update

GCG’s Q2 2023 Healthcare Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q2 2023 AdTech and Marketing Services Industry Update

Q2 2023 AdTech and Marketing Services Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Strong M&A Market for Facilities Services

Strong M&A Market for Facilities Services

Perspectives

Facilities Services companies are in high demand for M&A, as this market segment continues to be one of the most active in the Business Services sector.

Q2 2023 Business Services Industry Update

Q2 2023 Business Services Industry Update

Industry Update

GCG’s Q2 2023 Business Services Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Q2 2023 E-Commerce Industry Update

Q2 2023 E-Commerce Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

August Food Industry Deal Dish

August Food Industry Deal Dish

Industry Update

Greenwich Capital Group's pulse on the current state of the Food & Beverage industry

3 Key Trends Driving M&A in Data Center Services

3 Key Trends Driving M&A in Data Center Services

Perspectives

With the rapid advancement of digital technologies, the adoption of cloud computing, and the increasing prevalence of data-intensive applications, the demand for data center services has experienced significant growth.

GCG Advises Pronto Repairs on its Sale to Tech24

GCG Advises Pronto Repairs on its Sale to Tech24

Latest News

Greenwich Capital Group is pleased to announce its role as the exclusive investment banker to Pronto Repairs on its sale to Tech24, a portfolio company of HCI Equity Partners.

Q2 2023 Auto & AutoTech Industry Update

Q2 2023 Auto & AutoTech Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q2 2023 Food & Beverage Industry Update

Q2 2023 Food & Beverage Industry Update

Industry Update

GCG’s Q2 2023 Food & Beverage Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Q2 2023 Aerospace & Defense Industry Update

Q2 2023 Aerospace & Defense Industry Update

Industry Update

GCG’s Q2 2023 A&D Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

GCG Advises on the Sale of 3 Birds to DAS Technology

GCG Advises on the Sale of 3 Birds to DAS Technology

Latest News

Greenwich Capital Group is pleased to announce its role as the exclusive financial advisor to 3 Birds Marketing on its sale to DAS Technology.

Retirement Plans, Tax Benefits and Empowered Employees: Unlocking the Potential of Cannabis Companies with an ESOP

Retirement Plans, Tax Benefits and Empowered Employees: Unlocking the Potential of Cannabis Companies with an ESOP

Perspectives

Retirement Plans, Tax Benefits and Empowered Employees: Unlocking the Potential of Cannabis Companies with an ESOP

Q2 2023 Middle Market M&A Update

Q2 2023 Middle Market M&A Update

Industry Update

GCG’s Middle Market M&A Update provides an overview of the latest trends in the market, including the recent performance of select sectors and the state of the middle market M&A environment.

A Rapidly Growing US Semiconductor Industry

A Rapidly Growing US Semiconductor Industry

Perspectives

A Rapidly Growing US Semiconductor Industry: Significant Investments in Infrastructure Bolstered by the CHIPS Act

How AI Will Impact M&A in the Middle Market: Trends to Expect

How AI Will Impact M&A in the Middle Market: Trends to Expect

Perspectives

How AI Will Impact M&A in the Middle Market: Trends to Expect

Medical Devices and Equipment Industry Perspectives

Medical Devices and Equipment Industry Perspectives

Perspectives

Medical Devices and Equipment: GCG Industry Perspectives in Conjunction with FIME 2023

Greenwich Capital Group Welcomes Summer 2023 Interns

Greenwich Capital Group Welcomes Summer 2023 Interns

Latest News

GCG has expanded upon last year's intern class and welcomed eight interns for the summer of 2023, reflecting our commitment to growth and providing opportunities for college students.

Q1 2023 Business Services Industry Update

Q1 2023 Business Services Industry Update

Industry Update

GCG’s Q1 2023 Business Services Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Capital Flow into the Automotive Industry is Surging

Capital Flow into the Automotive Industry is Surging

Perspectives

The auto industry is undergoing a remarkable transformation driven by several key trends. From electric and hybrid vehicles to autonomous driving and advanced connectivity, these trends are revolutionizing the industry, pushing automakers to reimagine their business models and invest in groundbreaking technologies.

Q1 2023 Industrials Industry Update

Q1 2023 Industrials Industry Update

Industry Update

GCG’s Q1 2023 Industrials Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Q1 2023 E-Commerce Industry Update

Q1 2023 E-Commerce Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q1 2023 AdTech and Marketing Services Industry Update

Q1 2023 AdTech and Marketing Services Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

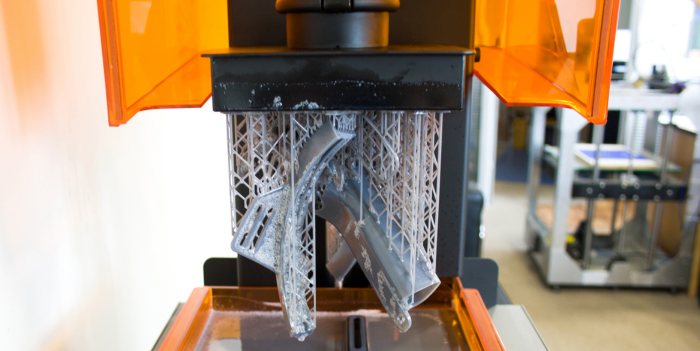

3D Printing and Additive Manufacturing

3D Printing and Additive Manufacturing

Perspectives

3D Printing and Additive Manufacturing: GCG Industry Perspectives Following RAPID + TCT 2023

GCG Advises on the Sale of RXA to OneMagnify

GCG Advises on the Sale of RXA to OneMagnify

Latest News

Greenwich Capital Group is pleased to announce its role as the exclusive financial advisor to RXA on its sale to OneMagnify, a portfolio company of Crestview Partners.

Q1 2023 Food & Beverage Industry Update

Q1 2023 Food & Beverage Industry Update

Industry Update

GCG’s Q1 2023 Food & Beverage Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Maximizing Value in Middle Market M&A

Maximizing Value in Middle Market M&A

Perspectives

While the U.S. economy is still advancing and many of the underlying economic indicators are still positive, there is no doubt that we are in an uncertain economic environment. Given the economic headwinds, the room for error in a transaction process has tightened.

Q1 2023 Healthcare Industry Update

Q1 2023 Healthcare Industry Update

Industry Update

GCG’s Q1 2023 Healthcare Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q1 2023 Middle Market Private Equity Update

Q1 2023 Middle Market Private Equity Update

Industry Update

GCG’s Q1 2023 Middle Market Private Equity Update provides an overview of the latest trends in the market.

Q1 2023 Aerospace & Defense Industry Update

Q1 2023 Aerospace & Defense Industry Update

Industry Update

GCG’s Q1 2023 A&D Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q1 2023 Middle Market M&A Update

Q1 2023 Middle Market M&A Update

Industry Update

GCG’s Middle Market M&A Update provides an overview of the latest trends in the market, including the recent performance of select sectors and the state of the middle market M&A environment.

Navigating the Evolving M&A Landscape in the Food & Beverage Sector

Navigating the Evolving M&A Landscape in the Food & Beverage Sector

Perspectives

Management buyouts and employee stock ownership plans provide a transfer of ownership for the current shareholders and involve the management team or employees having a vested interest going forward. However, there are key differences between each of these options that may make one option more attractive.

Management Buyout vs ESOP

Management Buyout vs ESOP

Perspectives

Management buyouts and employee stock ownership plans provide a transfer of ownership for the current shareholders and involve the management team or employees having a vested interest going forward. However, there are key differences between each of these options that may make one option more attractive.

Top 10 Trends from Natural Foods Expo West 2023

Top 10 Trends from Natural Foods Expo West 2023

Perspectives

Top 10 Trends from Natural Foods Expo West 2023

Q4 2022 Industrials Industry Update

Q4 2022 Industrials Industry Update

Industry Update

GCG’s Q4 2022 Industrials Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

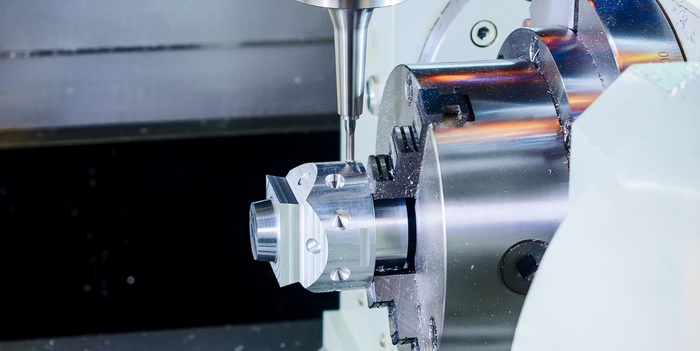

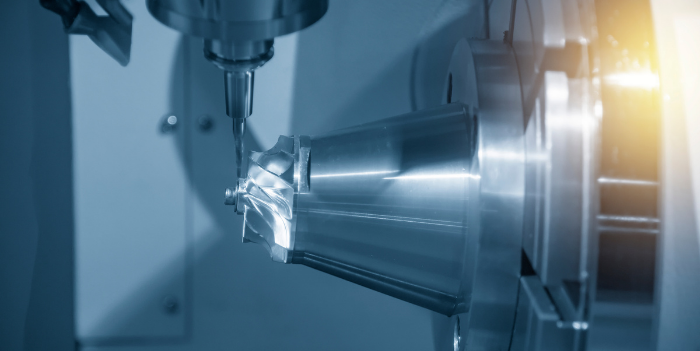

Precision Machining and Metal Forming: A Robust M&A Market

Precision Machining and Metal Forming: A Robust M&A Market

Perspectives

Precision Machining and Metal Forming: A Robust M&A Market for Companies Focused on Aerospace & Defense and Other Mission-Critical Industries

GCG Advises on the Sale of D&R Machine Company to Cadrex Manufacturing Solutions

GCG Advises on the Sale of D&R Machine Company to Cadrex Manufacturing Solutions

Latest News

Greenwich Capital Group is pleased to announce its role as the exclusive investment banker to D&R Machine Company on its sale to Cadrex Manufacturing.

Q4 2022 Food & Beverage Industry Update

Q4 2022 Food & Beverage Industry Update

Industry Update

GCG’s Q4 2022 Food & Beverage Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Q4 2022 AutoTech Industry Update

Q4 2022 AutoTech Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q4 2022 AdTech and Marketing Services Industry Update

Q4 2022 AdTech and Marketing Services Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q4 2022 E-Commerce Industry Update

Q4 2022 E-Commerce Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q4 2022 Business Services Industry Update

Q4 2022 Business Services Industry Update

Industry Update

GCG’s Q4 2022 Business Services Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Q4 2022 Healthcare Industry Update

Q4 2022 Healthcare Industry Update

Industry Update

GCG’s Q4 2022 Healthcare Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q4 2022 Middle Market Private Equity Update

Q4 2022 Middle Market Private Equity Update

Industry Update

GCG’s Q4 2022 Middle Market Private Equity Update provides an overview of the latest trends in the market.

Q4 2022 Automotive Industry Update

Q4 2022 Automotive Industry Update

Industry Update

GCG’s Q4 2022 Automotive Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q4 2022 Aerospace & Defense Industry Update

Q4 2022 Aerospace & Defense Industry Update

Industry Update

GCG’s Q4 2022 A&D Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

GCG Advises on the Sale of Cameron Tool Corporation to Tool Tech

GCG Advises on the Sale of Cameron Tool Corporation to Tool Tech

Latest News

Greenwich Capital Group is pleased to announce its role as the exclusive financial advisor to Cameron Tool Corporation on its sale to Tool Tech.

Q4 2022 Transportation & Logistics Industry Update

Q4 2022 Transportation & Logistics Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q4 2022 Middle Market M&A Update

Q4 2022 Middle Market M&A Update

Industry Update

GCG’s Middle Market M&A Update provides an overview of the latest trends in the market, including the recent performance of select sectors and the state of the middle market M&A environment.

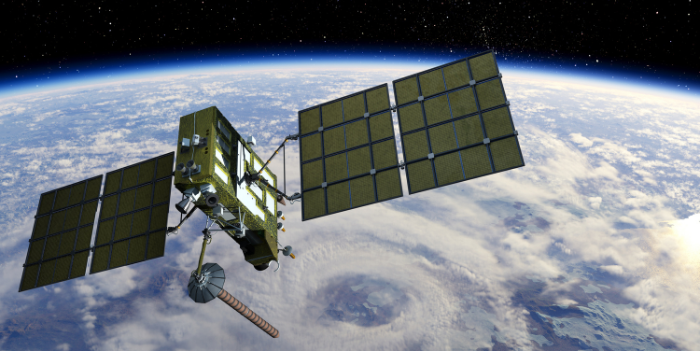

Satellite Communications: Increased Connectivity, Applications and Affordability

Satellite Communications: Increased Connectivity, Applications and Affordability

Perspectives

With increased affordability, as well as improved hardware and software interfaces from a customer-use perspective, satellite communication applications continue to grow.

GCG Advises on the Sale of Great Lakes Potato Chip Company to LaSalle Capital

GCG Advises on the Sale of Great Lakes Potato Chip Company to LaSalle Capital

Latest News

Greenwich Capital Group is pleased to announce its role as the exclusive financial advisor to Great Lakes Potato Chip Company on its sale to LaSalle Capital.

M&A Trends in Home and Commercial Services

M&A Trends in Home and Commercial Services

Perspectives

One of the strongest and most active sectors in middle-market M&A continues to be home and commercial services.

GCG Advises LinTech Global on its Acquisition by Digital Intelligence Systems

GCG Advises LinTech Global on its Acquisition by Digital Intelligence Systems

Latest News

Greenwich Capital Group is pleased to announce its role as financial advisor to LinTech Global on its acquisition by Digital Intelligence Systems.

GCG Advises AcquireCrowd on its Management Buyout

GCG Advises AcquireCrowd on its Management Buyout

Latest News

GCG is pleased to announce its role as the exclusive financial advisor to Reserve Tech, Inc. also branded as AcquireCrowd on its management buyout transaction.

GCG Advises United Vein & Vascular Centers on its acquisition by Amulet Capital Partners

GCG Advises United Vein & Vascular Centers on its acquisition by Amulet Capital Partners

Latest News

Greenwich Capital Group is pleased to announce its role as the exclusive financial advisor to United Vein & Vascular Centers on its acquisition by Amulet Capital Partners, LP.

Q3 2022 AutoTech Industry Update

Q3 2022 AutoTech Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q3 2022 Transportation & Logistics Industry Update

Q3 2022 Transportation & Logistics Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

GCG Advises on the Sale of DRYmedic Restoration Services to Authority Brands

GCG Advises on the Sale of DRYmedic Restoration Services to Authority Brands

Latest News

Greenwich Capital Group is pleased to announce its role as the exclusive financial advisor to DRYmedic Restoration Services on its sale to Authority Brands.

Q3 2022 Industrials Industry Update

Q3 2022 Industrials Industry Update

Industry Update

GCG’s Q3 2022 Industrials Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Q3 2022 Automotive Industry Update

Q3 2022 Automotive Industry Update

Industry Update

GCG’s Q3 2022 Automotive Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q3 2022 Food & Beverage Industry Update

Q3 2022 Food & Beverage Industry Update

Industry Update

GCG’s Q3 2022 Food & Beverage Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Q3 2022 AdTech and Marketing Services Industry Update

Q3 2022 AdTech and Marketing Services Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q3 2022 E-Commerce Industry Update

Q3 2022 E-Commerce Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q3 2022 Healthcare Industry Update

Q3 2022 Healthcare Industry Update

Industry Update

GCG’s Q3 2022 Healthcare Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q3 2022 Middle Market M&A Update

Q3 2022 Middle Market M&A Update

Industry Update

GCG’s Middle Market M&A Update provides an overview of the latest trends in the market, including the recent performance of select sectors and the state of the middle market M&A environment.

Q3 2022 Middle Market Private Equity Update

Q3 2022 Middle Market Private Equity Update

Industry Update

GCG’s Q3 2022 Middle Market Private Equity Update provides an overview of the latest trends in the market.

Q3 2022 Aerospace & Defense Industry Update

Q3 2022 Aerospace & Defense Industry Update

Industry Update

GCG’s Q3 2022 A&D Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q2 2022 Industrials Industry Update

Q2 2022 Industrials Industry Update

Industry Update

GCG’s Q2 2022 Industrials Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

M&A Temperature Check. What is Hot, What is Not in 2022

M&A Temperature Check. What is Hot, What is Not in 2022

Perspectives

There are more headwinds facing buyers and sellers in the current economic climate than in 2021. Rising interest rates, supply chain disruptions, higher energy prices, and surging inflation have clearly impacted the M&A market and certain industry sectors have fared much better than others.

Q2 2022 Food & Beverage Industry Update

Q2 2022 Food & Beverage Industry Update

Industry Update

GCG’s Q2 2022 Food & Beverage Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Q2 2022 E-Commerce Industry Update

Q2 2022 E-Commerce Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

GCG Advises on the Sale of Montage Furniture Services to One80

GCG Advises on the Sale of Montage Furniture Services to One80

Latest News

Greenwich Capital Group is pleased to announce its role as the exclusive financial advisor to Montage Furniture Services on its sale to One80 Intermediaries.

Impact of Privacy Policy Changes on the Advertising Industry

Impact of Privacy Policy Changes on the Advertising Industry

Perspectives

As privacy changes loom, the advertising sector is expected to undergo fundamental changes. The privacy-centric policies are impacting advertisers by depriving them of customer data needed to optimize ads.

Current Trends Impacting Steel and the Overall Metals Industry

Current Trends Impacting Steel and the Overall Metals Industry

Perspectives

Macro-economic and geo-political factors have had a significant impact on the industry. Key factors include unprecedented inflation, supply chain disruptions, the Russia/Ukraine war, accelerating demand, and the continued impact of COVID.

Q2 2022 AdTech and Marketing Services Industry Update

Q2 2022 AdTech and Marketing Services Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Key Auto Tech Dealership Trends in 2022

Key Auto Tech Dealership Trends in 2022

Perspectives

The automotive dealership industry is rapidly transforming due to evolving customer expectations, increased EV sales, technology adoption, supply constraints, and fuel prices. These factors have led to a significant shift in auto dealership trends.

Q2 2022 Metals & Mining Industry Update

Q2 2022 Metals & Mining Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q2 2022 Automotive Industry Update

Q2 2022 Automotive Industry Update

Industry Update

GCG’s Q2 2022 Automotive Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q2 2022 Healthcare Industry Update

Q2 2022 Healthcare Industry Update

Industry Update

GCG’s Q2 2022 Healthcare Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q2 2022 Middle Market M&A Update

Q2 2022 Middle Market M&A Update

Industry Update

GCG’s Middle Market M&A Update provides an overview of the latest trends in the market, including the recent performance of select sectors and the state of the middle market M&A environment.

Q2 2022 Aerospace & Defense Industry Update

Q2 2022 Aerospace & Defense Industry Update

Industry Update

GCG’s Q2 2022 A&D Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q2 2022 Middle Market Private Equity Update

Q2 2022 Middle Market Private Equity Update

Industry Update

GCG’s Q2 2022 Middle Market Private Equity Update provides an overview of the latest trends in the market.

GCG Advises on the Sale of Blue Sky Network to ACR Group

GCG Advises on the Sale of Blue Sky Network to ACR Group

Latest News

Greenwich Capital Group is pleased to announce its role as the exclusive financial advisor to Blue Sky Network on its sale to ACR Group Corporation.

Q1 2022 Healthcare Industry Update

Q1 2022 Healthcare Industry Update

Industry Update

GCG’s Q1 2022 Healthcare Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q1 2022 Metals & Mining Industry Update

Q1 2022 Metals & Mining Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q1 2022 Transportation & Logistics Industry Update

Q1 2022 Transportation & Logistics Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q1 2022 Industrials Industry Update

Q1 2022 Industrials Industry Update

Industry Update

GCG’s Q1 2022 Industrials Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Greenwich Capital Group Welcomes Summer 2022 Interns

Greenwich Capital Group Welcomes Summer 2022 Interns

Latest News

Greenwich Capital Group ("GCG") is excited to highlight our 2022 summer interns. Due to high market activity and GCG’s growth over the past year, GCG was able to expand upon last year’s intern class and bring on four interns for the summer of 2022.

Q1 2022 AdTech and Marketing Services Industry Update

Q1 2022 AdTech and Marketing Services Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q1 2022 Food & Beverage Industry Update

Q1 2022 Food & Beverage Industry Update

Industry Update

GCG’s Q1 2022 Food & Beverage Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Q1 2022 Automotive Industry Update

Q1 2022 Automotive Industry Update

Industry Update

GCG’s Q1 2022 Automotive Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q1 2022 Middle Market M&A Update

Q1 2022 Middle Market M&A Update

Industry Update

GCG’s Middle Market M&A Update provides an overview of the latest trends in the market, including the recent performance of select sectors and the state of the middle market M&A environment.

Q1 2022 Middle Market Private Equity Update

Q1 2022 Middle Market Private Equity Update

Industry Update

GCG’s Q1 2022 Middle Market Private Equity Update provides an overview of the latest trends in the market.

Q1 2022 Aerospace & Defense Industry Update

Q1 2022 Aerospace & Defense Industry Update

Industry Update

GCG’s Q1 2022 A&D Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

GCG Advises Shepler's Ferry on its Partnership with The Hoffman Family of Companies

GCG Advises Shepler's Ferry on its Partnership with The Hoffman Family of Companies

Latest News

Greenwich Capital Group is pleased to announce its role as the exclusive financial advisor to Shepler’s Ferry Inc. on its partnership with The Hoffmann Family of Companies.

GCG Advises ArcaMax on its Merger with Zeta Global

GCG Advises ArcaMax on its Merger with Zeta Global

Latest News

Greenwich Capital Group is pleased to announce its role as the exclusive financial advisor to ArcaMax Publishing, Inc. on its merger with Zeta Global Holdings Corp. (NYSE: ZETA).

GCG's ESOP Group Advises on the Sale of Spence Brothers Inc.

GCG's ESOP Group Advises on the Sale of Spence Brothers Inc.

Latest News

Greenwich Capital Group is pleased to announce its role as the exclusive financial advisor to Spence Brothers Inc. on its sale of equity to the Spence Brothers Employee Stock Ownership Plan (“ESOP”).

Q4 2021 AdTech and Marketing Services Industry Update

Q4 2021 AdTech and Marketing Services Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Factors That Enhance The Value of Field Service Companies

Factors That Enhance The Value of Field Service Companies

Perspectives

Owners of middle-market companies need to balance growth versus profits; at the same time, positioning the company for greater value in a future sale is also important.

Q4 2021 Transportation & Logistics Industry Update

Q4 2021 Transportation & Logistics Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

GCG Advises Spin Master on the Sale of its Outdoor Manufacturing Operations to Comfort Research

GCG Advises Spin Master on the Sale of its Outdoor Manufacturing Operations to Comfort Research

Latest News

Greenwich Capital Group is pleased to announce its role as the exclusive financial advisor to Spin Master Corp. on the sale of its Outdoor manufacturing operations in Tarboro, North Carolina, and specific product lines from Spin Master's Outdoor portfolio to Comfort Research.

Q4 2021 Metals & Mining Industry Update

Q4 2021 Metals & Mining Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q4 2021 Aerospace & Defense Industry Update

Q4 2021 Aerospace & Defense Industry Update

Industry Update

GCG’s Q4 2021 A&D Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q4 2021 Healthcare Industry Update

Q4 2021 Healthcare Industry Update

Industry Update

GCG’s Q4 2021 Healthcare Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q4 2021 Business Services Industry Update

Q4 2021 Business Services Industry Update

Industry Update

GCG’s Q4 2021 Business Services Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Q4 2021 Food & Beverage Industry Update

Q4 2021 Food & Beverage Industry Update

Industry Update

GCG’s Q4 2021 Food & Beverage Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Q4 2021 Middle Market Private Equity Update

Q4 2021 Middle Market Private Equity Update

Industry Update

GCG’s Q4 2021 Middle Market Private Equity Update provides an overview of the latest trends in the market.

Q4 2021 Industrials Industry Update

Q4 2021 Industrials Industry Update

Industry Update

GCG’s Q4 2021 Industrials Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Q4 2021 Middle Market M&A Update

Q4 2021 Middle Market M&A Update

Industry Update

GCG’s Middle Market M&A Update provides an overview of the latest trends in the market, including the recent performance of select sectors and the state of the middle market M&A environment.

Q4 2021 Automotive Industry Update

Q4 2021 Automotive Industry Update

Industry Update

GCG’s Q4 2021 Automotive Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

GCG Advises Arotech on the Acquisition of Advance Circuit Technology

GCG Advises Arotech on the Acquisition of Advance Circuit Technology

Latest News

Greenwich Capital Group is pleased to announce its role as an advisor to Arotech on the acquisition of Advance Circuit Technology.

Is a Sell-Side Quality of Earnings Worth It?

Is a Sell-Side Quality of Earnings Worth It?

Perspectives

As a seller, it is important to have a deep understanding of your financials to ensure you aren’t leaving value on the table.

GCG Advises Harper Woods Veterinary Hospital on its Partnership with Heartland Veterinary Partners

GCG Advises Harper Woods Veterinary Hospital on its Partnership with Heartland Veterinary Partners

Latest News

Greenwich Capital Group is pleased to announce its role as the exclusive financial advisor to Harper Woods Veterinary Hospital on its partnership with Heartland Veterinary Partners, a portfolio company of Gryphon Investors.

Q3 2021 Metals & Mining Industry Update

Q3 2021 Metals & Mining Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

2021 Will Be a Record Year for Middle-Market M&A, but 2022 Will Be a Better Year for Sellers

2021 Will Be a Record Year for Middle-Market M&A, but 2022 Will Be a Better Year for Sellers

Perspectives

While many businesses rushed to get to an exit in 2021, we believe that businesses that make the move in 2022 will reap significant benefits. These benefits will include higher multiples, more buyers pursuing a deal, and a more efficient deal process. Based on the economic environment and the other factors, 2022 appears to be a great seller’s market.

GCG Advises Princeton Precision Group on the Acquisition of Tampa Bay Machining

GCG Advises Princeton Precision Group on the Acquisition of Tampa Bay Machining

Latest News

Greenwich Capital Group (“GCG”) is pleased to announce its role as the exclusive financial advisor to Princeton Precision Group (“PPG”) on the acquisition of Tampa Bay Machining.

Q3 2021 Industrials Industry Update

Q3 2021 Industrials Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q3 2021 Business Services Industry Update

Q3 2021 Business Services Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q3 2021 Food & Beverage Industry Update

Q3 2021 Food & Beverage Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q3 2021 Healthcare Industry Update

Q3 2021 Healthcare Industry Update

Industry Update

GCG’s Q3 2021 Healthcare Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q3 2021 Aerospace & Defense Industry Update

Q3 2021 Aerospace & Defense Industry Update

Industry Update

GCG’s Q3 2021 A&D Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q3 2021 Automotive Industry Update

Q3 2021 Automotive Industry Update

Industry Update

GCG’s Q3 2021 Automotive Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q3 2021 Middle Market Private Equity Update

Q3 2021 Middle Market Private Equity Update

Industry Update

GCG’s Q3 2021 Middle Market Private Equity Update provides an overview of the latest trends in the market.

Q3 2021 Middle Market M&A Update

Q3 2021 Middle Market M&A Update

Industry Update

GCG’s Middle Market M&A Update provides an overview of the latest trends in the market, including the recent performance of select sectors and the state of the middle market M&A environment.

Q2 2021 Industrials Industry Update

Q2 2021 Industrials Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Inside The Green Industry

Inside The Green Industry

Perspectives

Inside the Green Industry: A Look at the Current Market and What is Driving a Compelling Environment for Sellers of Landscaping and Vegetation Management Companies

Q2 2021 Middle Market Private Equity Update

Q2 2021 Middle Market Private Equity Update

Industry Update

GCG’s Q2 2021 Middle Market Private Equity Update provides an overview of the latest trends in the market.

Q2 2021 Food & Beverage Industry Update

Q2 2021 Food & Beverage Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q2 2021 Healthcare Industry Update

Q2 2021 Healthcare Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q2 2021 Aerospace & Defense Industry Update

Q2 2021 Aerospace & Defense Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q2 2021 Automotive Industry Update

Q2 2021 Automotive Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q2 2021 Business Services Industry Update

Q2 2021 Business Services Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q2 2021 Middle Market M&A Update

Q2 2021 Middle Market M&A Update

Industry Update

GCG’s Middle Market M&A Update provides an overview of the latest trends in the market, including the recent performance of select sectors and the state of the middle market M&A environment.

Greenwich Capital Group is Excited to Announce its Expansion into San Francisco

Greenwich Capital Group is Excited to Announce its Expansion into San Francisco

Latest News

Greenwich Capital Group LLC (“GCG”), a leading middle-market M&A advisory firm, continues to grow its industry depth and national coverage with the addition of Managing Director, Jeff Cruz. Jeff will lead GCG’s San Francisco office and its growing Technology industry presence.

Greenwich Capital Group Welcomes Summer 2021 Interns

Greenwich Capital Group Welcomes Summer 2021 Interns

Latest News

Greenwich Capital Group ("GCG") is excited to highlight our 2021 summer interns. As many of the uncertainties around the past year subside and our communities begin to re-open, GCG was committed to providing an opportunity to as many students as possible, ensuring these students gain a strong foundation in their pursuit of an investment banking career.

Q1 2021 Healthcare Industry Update

Q1 2021 Healthcare Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q1 2021 Food & Beverage Industry Update

Q1 2021 Food & Beverage Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

What to Consider When Selling Your Physician Practice

What to Consider When Selling Your Physician Practice

Perspectives

Following a record year of U.S. healthcare deal volume in 2020, healthcare-focused investors are continuing to aggressively pursue acquisitions in the physician practice space. Physician-owners interested in seeking strategic partners to pursue their strategic objectives for their practices and liquidity for their partners must consider many factors. We’ve broken down several considerations below, with a focus on transaction preparation and alternative transaction structures.

Q1 2021 Aerospace & Defense Industry Update

Q1 2021 Aerospace & Defense Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Greenwich Capital Group is Honored to Be Recognized by Inc. Magazine as one of the Best Workplaces in the U.S. for 2021

Greenwich Capital Group is Honored to Be Recognized by Inc. Magazine as one of the Best Workplaces in the U.S. for 2021

Latest News

Greenwich Capital Group (“GCG”) is pleased to announce it has been named to Inc. magazine’s annual list of the Best Workplaces for 2021.

Q1 2021 Automotive Industry Update

Q1 2021 Automotive Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q1 2021 Middle Market Private Equity Update

Q1 2021 Middle Market Private Equity Update

Industry Update

GCG’s Q1 2021 Middle Market Private Equity Update provides an overview of latest trends in the market.

Q1 2021 Middle Market M&A Update

Q1 2021 Middle Market M&A Update

Industry Update

GCG’s Middle Market M&A Update provides an overview of the latest trends in the market, including recent performance of select sectors and the state of the middle market M&A environment.

Greenwich Capital Group Continues its Rapid Growth with the Addition of Jeremy Somers

Greenwich Capital Group Continues its Rapid Growth with the Addition of Jeremy Somers

Latest News

Greenwich Capital Group LLC is pleased to announce the addition of Jeremy Somers as a Director in its investment banking business.

GCG Advises on the Partnership of Southeast Michigan's Premier Ophthalmology Physician Group and Ambulatory Surgery Center to Midwest Vision Partners

GCG Advises on the Partnership of Southeast Michigan's Premier Ophthalmology Physician Group and Ambulatory Surgery Center to Midwest Vision Partners

Latest News

GCG is pleased to announce its role as the exclusive financial advisor to Grosinger, Spigelman & Grey (“GSG”), Cataract and Eye Consultants of Michigan (“CECOM”) and Eye Surgery Center of Michigan (“ESCM”), or the “Practices”, on its partnership with Midwest Vision Partners (“MVP”), a portfolio company of Alpine Investors.

GCG's ESOP Group Advises on the Sale of SAC Ventures

GCG's ESOP Group Advises on the Sale of SAC Ventures

Latest News

Greenwich Capital Group (“GCG”) is pleased to announce its role as the exclusive financial advisor to SAC Ventures, Inc. and its subsidiaries (the “Company), including Flat Rock Metal, Inc. (“FRM”) and Bar Processing Corporation (“BPC”), on its sale to the Flat Rock Metal and Bar Processing Employee Stock Ownership Plan (“ESOP”).

GCG Advises on the Sale of Kors Engineering to Plex Systems

GCG Advises on the Sale of Kors Engineering to Plex Systems

Latest News

Greenwich Capital Group (“GCG”) is pleased to announce its role as the exclusive financial advisor to Kors Engineering Company (“Kors”) on its sale to Plex Systems (“Plex”), the leader in cloud-delivered smart manufacturing solutions.

Deal Digest: McCormick (NYSE: MKC) Acquires Cholula

Deal Digest: McCormick (NYSE: MKC) Acquires Cholula

Perspectives

The hot sauce industry has grown significantly in recent years due to increasing consumer interest in spicy flavoring and low-calorie options. McCormick looks to take advantage of this recent opportunity with its acquisition of The Cholula Food Company (“Cholula”).

Q4 2020 Food & Beverage Industry Update

Q4 2020 Food & Beverage Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q4 2020 Middle Market Private Equity Update

Q4 2020 Middle Market Private Equity Update

Industry Update

GCG’s Q4 2020 Middle Market Private Equity Update provides an overview of latest trends in the market.

Q4 2020 Middle Market M&A Update

Q4 2020 Middle Market M&A Update

Industry Update

GCG’s Middle Market M&A Update provides an overview of the latest trends in the market, including recent performance of select sectors and the state of the middle market M&A environment.

Q4 2020 Aerospace & Defense Industry Update

Q4 2020 Aerospace & Defense Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q4 2020 Healthcare Industry Update

Q4 2020 Healthcare Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q4 2020 Automotive Industry Update

Q4 2020 Automotive Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Greenwich Capital Group Celebrates 5-Year Anniversary

Greenwich Capital Group Celebrates 5-Year Anniversary

Latest News

Greenwich Capital Group (“GCG”) is pleased to celebrate the milestone of its 5-year anniversary. From inception, GCG has been built on the core principles of hiring, retaining, and motivating a team of entrepreneurial, world-class professionals with deep industry expertise to meet and exceed the objectives of its clients while delivering the highest ethical standards.

GCG Advises on the Sale of KFT Fire Trainer

GCG Advises on the Sale of KFT Fire Trainer

Latest News

Greenwich Capital Group (“GCG”) is pleased to announce its role as the exclusive financial advisor to Keystone Capital on the sale of KFT Fire Trainer (“KFT”) to an investor group led by KFT management.

Deal Diagnostic: Addus (NASDAQ: ADUS) Acquires Queen City Hospice from Stonehenge Partners

Deal Diagnostic: Addus (NASDAQ: ADUS) Acquires Queen City Hospice from Stonehenge Partners

Perspectives

Consolidation in the home health and hospice industry has picked up in recent months, as uncertainty brought on by the COVID-19 pandemic in the first half of 2020 have started to subside. Following this trend was the recent announcement of the sale of Cincinnati, Ohio-based Queen City Hospice and its affiliate Miracle City Hospice to homecare firm Addus Homecare (NASDAQ: ADUS).

GCG Advises on the Sale of Proos Manufacturing

GCG Advises on the Sale of Proos Manufacturing

Latest News

Greenwich Capital Group (“GCG”) is pleased to announce its role as the exclusive financial advisor to Proos Manufacturing, Inc. (“Proos”) on its sale to Westbourne Capital Partners (“WCP”).

November 2020 Food & Beverage Pulse

November 2020 Food & Beverage Pulse

Industry Update

GCG's November 2020 Food & Beverage Pulse provides an overview on recent news topics and trends within the Food & Beverage sector.

Q3 2020 Middle Market Private Equity Update

Q3 2020 Middle Market Private Equity Update

Industry Update

In the first half of 2020, private equity deal volume dropped approximately 35%. GCG’s Q2 2020 Middle Market Private Equity Update provides an overview of latest trends in the market.

Q3 2020 Middle Market Update

Q3 2020 Middle Market Update

Industry Update

GCG’s Middle Market Update provides an overview of the latest trends in the market, including recent performance of select sectors and the state of the middle market M&A environment.

Q3 2020 Healthcare Industry Update

Q3 2020 Healthcare Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q3 2020 Food & Beverage Industry Update

Q3 2020 Food & Beverage Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q3 2020 Aerospace & Defense Industry Update

Q3 2020 Aerospace & Defense Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q3 2020 Automotive Industry Update

Q3 2020 Automotive Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

ESOPs for Middle Market Automotive Companies - A Match Made in Shareholder Liquidity Heaven

ESOPs for Middle Market Automotive Companies - A Match Made in Shareholder Liquidity Heaven

Perspectives

If you own an automotive business and are looking for an exit or to achieve liquidity over the next few years, an ESOP could offer tremendous opportunities which you could not achieve in a typical M&A sale. Why is this a perfect alignment?

GCG’s Andrew Dickow Selected as a '40 Under 40' Honoree by Crain's Detroit Business

GCG’s Andrew Dickow Selected as a '40 Under 40' Honoree by Crain's Detroit Business

Latest News

GCG's Managing Director and Food and Beverage practice leader, Andrew Dickow, has been selected as a 2020 "40 under 40” honoree by Crain's Detroit Business

September 2020 Food & Beverage Pulse

September 2020 Food & Beverage Pulse

Industry Update

GCG's September 2020 Food & Beverage Pulse provides an overview on recent news topics and trends within the Food & Beverage sector.

Q2 2020 Middle Market Private Equity Update

Q2 2020 Middle Market Private Equity Update

Industry Update

In the first half of 2020, private equity deal volume dropped approximately 35%. GCG’s Q2 2020 Middle Market Private Equity Update provides an overview of latest trends in the market.

Q2 2020 Automotive Industry Update

Q2 2020 Automotive Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q2 2020 Middle Market Update

Q2 2020 Middle Market Update

Industry Update

GCG’s Middle Market Update provides an overview of the latest trends in the market, including recent performance of select sectors and the state of the middle market M&A environment.

Q2 2020 Aerospace & Defense Industry Update

Q2 2020 Aerospace & Defense Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q2 2020 Healthcare Industry Update

Q2 2020 Healthcare Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q2 2020 Food & Beverage Industry Update