Reaching New Altitudes

Private Equity Investments in the Aerospace and Defense Industry

The Aerospace and Defense (“A&D”) industry represents a sector of prioritized interest and activity for a significant number of industrial-oriented private equity (“PE”) groups, many of whom have deep backgrounds and years of consistent focus on the A&D market. While strategic buyers remain active, the proliferation of private equity interest and favorable industry dynamics have made these investors highly competitive and visible within the A&D landscape.

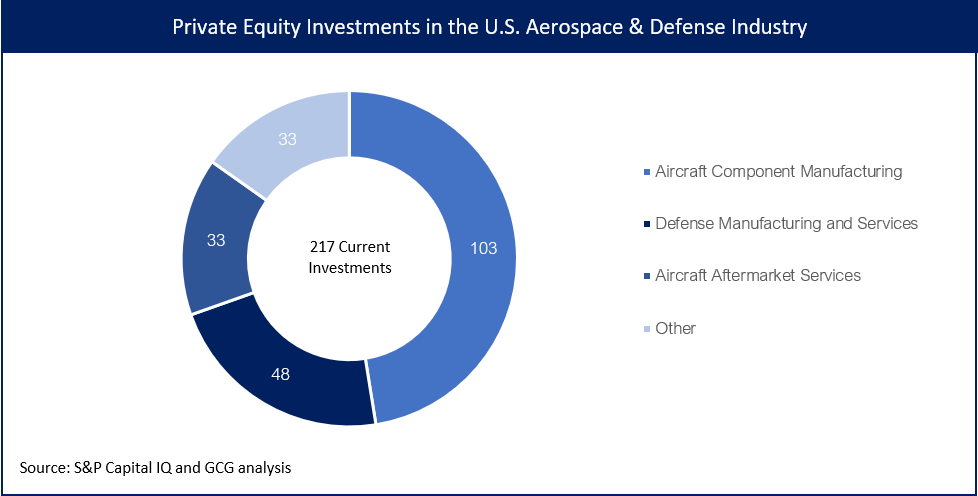

It is worth recognizing that broad PE interest in the A&D sector has not always been the case, as some firms historically held a much more conservative view of the industry due to customer concentration and cyclicality concerns. However, PE activity continues to highlight A&D companies as attractive and compelling investment opportunities in today’s M&A market. Demonstrating the extent of this interest, GCG’s A&D team has identified 217 U.S. A&D companies that are currently owned by or partnered with a PE firm. GCG further analyzed these companies to explore the specific factors and characteristics that are driving PE interest in the industry.

What has drawn private equity interest to the A&D industry?

Before discussing the factors specific to the A&D industry, it should be noted that the current private equity landscape is larger and more hungry than ever. Today’s market is comprised of a greater number of firms that have raised increased levels of capital that must be deployed. With more competition for transactions comes not only increased valuations, but a heightened need to focus on sectors where there is meaningful visibility to continued growth. Across industrial markets, few sectors can match the A&D industry in this regard.

This is particularly the case within the commercial aerospace sector. As the demand for global air travel has continued to grow, so too has the need for more aircraft, in addition to the desire for new and more advanced versions to replace aging fleets. OEM order books have swelled and created record production backlogs, with some supply chains stretched to increase velocity and produce more aircraft per year. Few other industries can boast such multi-year backlogs by comparison (by some estimates, nearly 10 years of current production for select programs). From an acquisition perspective, thematic industry highlights also include OEM desires for a more consolidated supply chain, high certification requirements, long product lifecycles, significant aftermarket revenue streams, and relatively strong profit margins.

From a defense perspective, many of the same attractive industry dynamics in the commercial aerospace sector also apply to military aircraft and suppliers frequently support both markets. More broadly, while funding trends and visibility must be evaluated on a more detailed level across the vast ecosystem of defense related products and services, U.S. defense budgets remain the largest in the world by a wide margin. Bolstering that demand, the appetite for U.S. defense technology continues to be robust among foreign militaries.

Supply chain areas of emphasis

Looking deeper into the areas of the A&D supply chain with the highest levels of PE activity, GCG segmented each of the 217 identified companies into one of the 4 following categories.

Aircraft Component Manufacturing: 103 of the identified companies (47%) are involved in aircraft component manufacturing (commercial and/or military). Examples include businesses involved in machining, fabrication or assembly of items such as structural, engine or actuation related components, fittings and fasteners, tubing and ducting, and tooling. Many of the companies perform precision machining activities and/or other forms of value-add, build-to-print manufacturing. This aspect of the supply chain continues to be fragmented, with numerous PE firms having a specific consolidation objective to increase scale. While some of the companies in GCG’s identified universe develop and produce proprietary products and own their own designs, PE firms typically face significant competition for these businesses, from an acquisition perspective, from strategic buyers seeking to build out integrated systems offerings.

Defense Manufacturing and Services: 48 companies (22%) are involved in non-aircraft defense markets. The majority of this group are manufacturers – producing components or systems which support military products such as vehicles, ships, shelters, armor, ammunition, or defense electronics such as power solutions and ruggedized computing systems. A smaller portion of this segment is focused on defense services such as logistics, field support, surveillance and reconnaissance services, defense IT and systems engineering.

Aerospace Aftermarket Services: 33 companies (15%) are involved in aftermarket services primarily supporting commercial aircraft. The majority relate to maintenance, repair and overhaul (MRO) services for commercial, business or general aviation aircraft, engine or components. There are businesses in this category which are also involved in aftermarket parts distribution and fixed base operator (FBO) activities.

Other: 33 companies (15%) were identified that had a meaningful A&D focus but either did not fit cleanly into only one of the above categories and/or were more diversified across multiple industries.

Considerations for A&D industry business owners

The A&D industry continues to enjoy significant drivers of growth. Often however, the opportunity for growth can be accompanied by the need for meaningful additional capital investment. For some business owners, the prospect of partnering with a PE firm can represent not only a path to liquidity but also access to additional capital which can help fuel the continued expansion of the business. Moreover, numerous historical examples exist which demonstrate a PE firm acquiring multiple independent A&D businesses to create a larger (and more valuable) group of companies with a more diversified set of capabilities and customers.

Related Professionals

Get in Touch

Tell us a little about yourself and we will get in touch as soon as we can.

Back to news articles

Back to news articles