When contemplating retirement, business owners are faced with a decision regarding how to effectively transition their business while also ensuring they receive a fair value for what can be a lifetime of work. Many owners are hesitant to sell to outside private equity investors or strategic companies, which might also be their competitors. They are concerned about their employees, the business culture, and their legacy. These concerns can lead to a business owner having limited options when considering an exit. An alternative business succession structure is a management buyout (“MBO”) or employee stock ownership plan (“ESOP”). Each provides a transfer of ownership for the current shareholders and involves the management team or employees having a vested interest going forward. However, there are key differences between each of these options that may make one option more attractive.

MBO

An MBO is a transaction in which the company’s management team acquires the assets or equity of the business that they manage. These transactions are typically financed with cash from the management team, outside bank financing, a private equity investment, seller financing, or any combination thereof. In order to execute an effective MBO, the company needs to have an active management team that is comfortable taking on an ownership position in the business. This approach is limited by the sustainable cash flow required to repay the acquisition financing.

ESOP

An ESOP is a type of qualified retirement plan that invests primarily in the stock of the company. An ESOP involves establishing a trust in which employees participate. The company makes tax-deductible contributions to the ESOP in order to acquire shares or repay financing used to acquire shares. ESOPs can provide significant tax advantages, including allowing sellers to defer capital gains tax or companies to avoid income tax after the transaction. Upon completion of an ESOP transaction, employees receive allocations of company shares in retirement accounts based on seniority, compensation, age, or a combination thereof. In addition, management incentive plans can be implemented to provide a retention or incentive benefit to key members of management.

MBO vs. ESOP

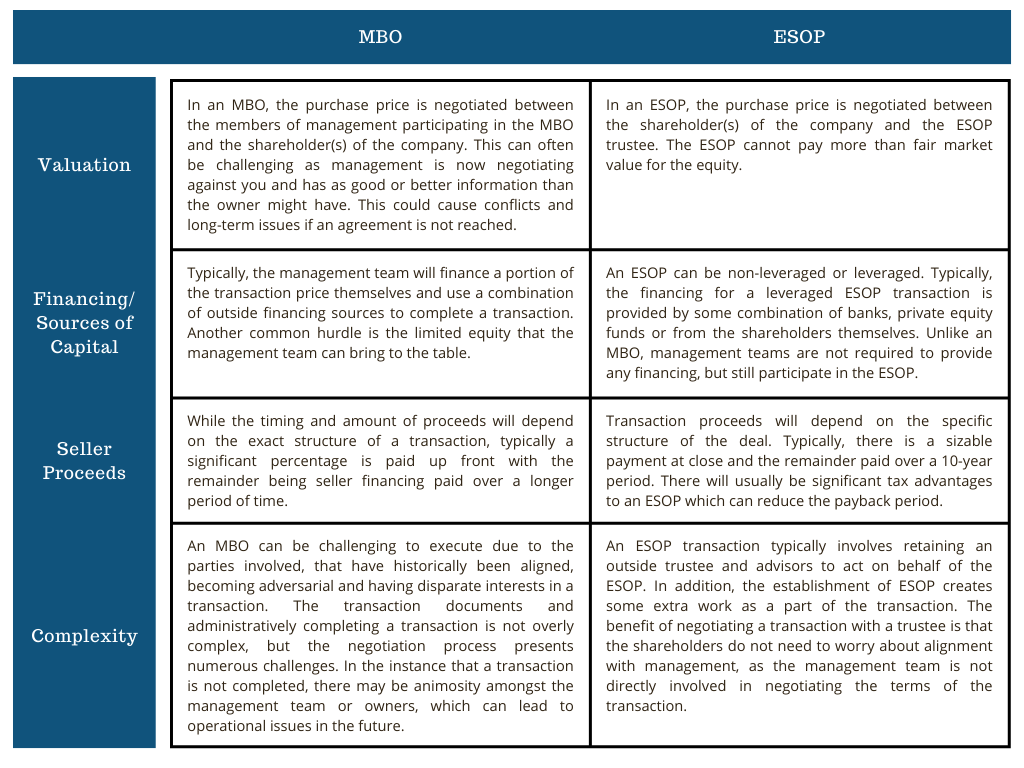

When evaluating the options available to transfer a business to the management team or employees successfully, several factors should be considered.

Overall, there are many advantages to selling a company to the management team and employees. When comparing an MBO to an ESOP in the context of transitioning ownership of a company, an ESOP often presents more compelling benefits to the parties involved. Greenwich Capital Group assists shareholders with evaluating all transaction options, including MBOs and ESOPs, to determine which structure may be best. If you have any questions regarding succession planning, MBOs, or ESOPs, please contact Brian Hock at bhock@greenwichgp.com.

Related Professionals

Get in Touch

Tell us a little about yourself and we will get in touch as soon as we can.

Back to news articles

Back to news articles