NEWS AND INSIGHTS

Featured News

GCG Advises on the Sale of Bay Cast Incorporated and Bay Cast Technologies to Auxo Investment Partners

GCG Advises on the Sale of Bay Cast Incorporated and Bay Cast Technologies to Auxo Investment Partners

Latest News

GCG is pleased to announce its role as the exclusive financial advisor to Bay Cast, an integrated steel casting and precision machining company based in Bay City, Michigan, on its sale to Auxo Investment Partners.

GCG Advises Variation Reduction Solutions, Inc. on its Acquisition of Inos from Grenzebach Maschinenbau GmbH

GCG Advises Variation Reduction Solutions, Inc. on its Acquisition of Inos from Grenzebach Maschinenbau GmbH

Latest News

GCG is pleased to announce its role as the exclusive financial advisor to Variation Reduction Solutions, Inc. on its acquisition of Inos Automationssoftware GmbH and Inos Hellas S.A. from Grenzebach Maschinenbau GmbH.

GCG Advises on the Recapitalization of Miller Industries with Tower Arch Capital

GCG Advises on the Recapitalization of Miller Industries with Tower Arch Capital

Latest News

GCG is pleased to announce its role as the exclusive financial advisor to the Miller family in the recapitalization of Miller Industries with Tower Arch Capital.

GCG Advises on the sale of Midwest Glass Fabricators to Oldcastle BuildingEnvelope®

GCG Advises on the sale of Midwest Glass Fabricators to Oldcastle BuildingEnvelope®

Latest News

Greenwich Capital Group is pleased to announce its role as the exclusive financial advisor to Midwest Glass Fabricators, Inc. on its sale to Oldcastle BuildingEnvelope, Inc.

GCG Advises on the sale of Woodharbor Molding & Millworks to WF Cabinetry Group

GCG Advises on the sale of Woodharbor Molding & Millworks to WF Cabinetry Group

Latest News

Greenwich Capital Group is pleased to announce its role as the exclusive financial advisor to Woodharbor Molding & Millworks, Inc. on its sale to WF Cabinetry Group, a portfolio company of HCI Equity Partners.

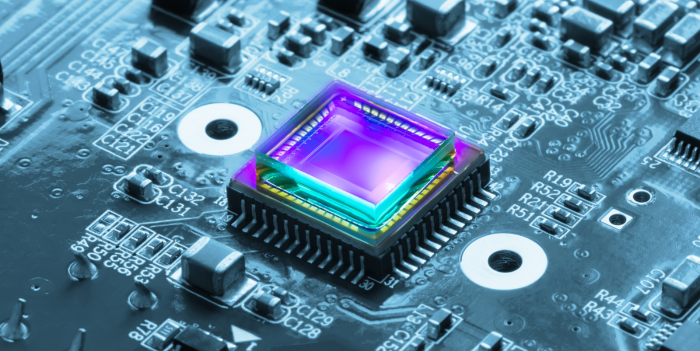

A Rapidly Growing US Semiconductor Industry

A Rapidly Growing US Semiconductor Industry

Perspectives

A Rapidly Growing US Semiconductor Industry: Significant Investments in Infrastructure Bolstered by the CHIPS Act

Medical Devices and Equipment Industry Perspectives

Medical Devices and Equipment Industry Perspectives

Perspectives

Medical Devices and Equipment: GCG Industry Perspectives in Conjunction with FIME 2023

Q1 2023 Industrials Industry Update

Q1 2023 Industrials Industry Update

Industry Update

GCG’s Q1 2023 Industrials Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

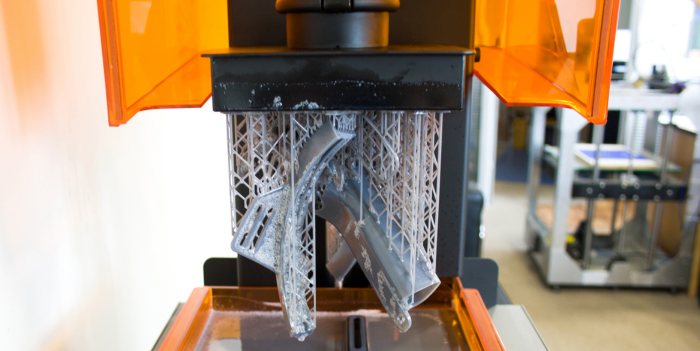

3D Printing and Additive Manufacturing

3D Printing and Additive Manufacturing

Perspectives

3D Printing and Additive Manufacturing: GCG Industry Perspectives Following RAPID + TCT 2023

Q4 2022 Industrials Industry Update

Q4 2022 Industrials Industry Update

Industry Update

GCG’s Q4 2022 Industrials Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

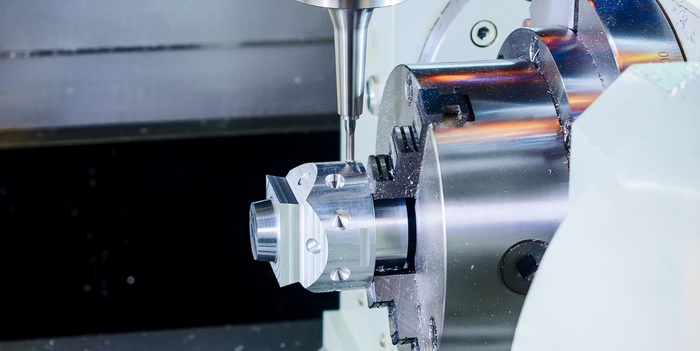

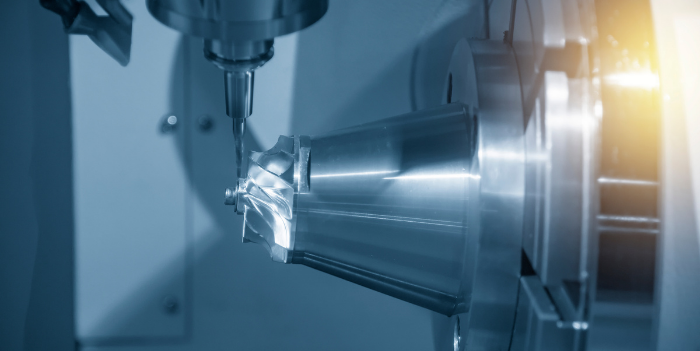

Precision Machining and Metal Forming: A Robust M&A Market

Precision Machining and Metal Forming: A Robust M&A Market

Perspectives

Precision Machining and Metal Forming: A Robust M&A Market for Companies Focused on Aerospace & Defense and Other Mission-Critical Industries

GCG Advises on the Sale of Cameron Tool Corporation to Tool Tech

GCG Advises on the Sale of Cameron Tool Corporation to Tool Tech

Latest News

Greenwich Capital Group is pleased to announce its role as the exclusive financial advisor to Cameron Tool Corporation on its sale to Tool Tech.

Q3 2022 Industrials Industry Update

Q3 2022 Industrials Industry Update

Industry Update

GCG’s Q3 2022 Industrials Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Q2 2022 Industrials Industry Update

Q2 2022 Industrials Industry Update

Industry Update

GCG’s Q2 2022 Industrials Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Q1 2022 Industrials Industry Update

Q1 2022 Industrials Industry Update

Industry Update

GCG’s Q1 2022 Industrials Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Q4 2021 Industrials Industry Update

Q4 2021 Industrials Industry Update

Industry Update

GCG’s Q4 2021 Industrials Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

GCG Advises Princeton Precision Group on the Acquisition of Tampa Bay Machining

GCG Advises Princeton Precision Group on the Acquisition of Tampa Bay Machining

Latest News

Greenwich Capital Group (“GCG”) is pleased to announce its role as the exclusive financial advisor to Princeton Precision Group (“PPG”) on the acquisition of Tampa Bay Machining.

Q3 2021 Industrials Industry Update

Q3 2021 Industrials Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q2 2021 Industrials Industry Update

Q2 2021 Industrials Industry Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

GCG's ESOP Group Advises on the Sale of SAC Ventures

GCG's ESOP Group Advises on the Sale of SAC Ventures

Latest News

Greenwich Capital Group (“GCG”) is pleased to announce its role as the exclusive financial advisor to SAC Ventures, Inc. and its subsidiaries (the “Company), including Flat Rock Metal, Inc. (“FRM”) and Bar Processing Corporation (“BPC”), on its sale to the Flat Rock Metal and Bar Processing Employee Stock Ownership Plan (“ESOP”).

GCG Advises on the Sale of Proos Manufacturing

GCG Advises on the Sale of Proos Manufacturing

Latest News

Greenwich Capital Group (“GCG”) is pleased to announce its role as the exclusive financial advisor to Proos Manufacturing, Inc. (“Proos”) on its sale to Westbourne Capital Partners (“WCP”).

GCG Advises AJR Filtration on its Acquisition of Delta Pure Filtration

GCG Advises AJR Filtration on its Acquisition of Delta Pure Filtration

Latest News

GCG is pleased to announce its role as an advisor to AJR Filtration on the acquisition of Delta Pure Filtration.

GCG Advises on the Sale of HomeFirst To Green Courte

GCG Advises on the Sale of HomeFirst To Green Courte

Latest News

GCG is pleased to announce its role as the exclusive financial advisor to HomeFirst Certified Communities ("HomeFirst") on its sale to Green Courte Partners, LLC ("Green Courte").

GCG Advises on the Sale of MASONPRO

GCG Advises on the Sale of MASONPRO

Latest News

GCG is pleased to announce its role as the exclusive financial advisor to MASONPRO on its sale to Construction Supply Group, a portfolio company of The Sterling Group.

Reaching New Altitudes | PE Interest in Aerospace & Defense

Reaching New Altitudes | PE Interest in Aerospace & Defense

Perspectives

GCG explores the favorable trends that are driving private equity interest in the Aerospace & Defense sector.

GCG Advises Horizon Global on the Sale of Harper Brush Works

GCG Advises Horizon Global on the Sale of Harper Brush Works

Latest News

Greenwich Capital Group (“GCG”) is pleased to announce its role as the exclusive financial advisor to Harper Brush Works (“Harper”), a division of Horizon Global (NYSE: HZN), on its sale to AMES Companies, Inc. (“AMES”), a subsidiary of Griffon Corporation (NYSE:GFF).

Q1 2018 Industrials Update

Q1 2018 Industrials Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Q4 2017 Industrials M&A Update

Q4 2017 Industrials M&A Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

GCG Advises Signal Holdings on its Recapitalization

GCG Advises Signal Holdings on its Recapitalization

Latest News

GCG is pleased to announce its role as the exclusive financial advisor to Signal Holdings, LLC and its subsidiaries on its recapitalization by Bank of America Merrill Lynch, which will allow the Company to support its continued growth.

GCG Advises McKechnie Vehicle Components In Raising Capital

GCG Advises McKechnie Vehicle Components In Raising Capital

Latest News

Greenwich Capital Group is pleased to announce its role advising McKechnie Vehicle Components USA, Inc. on its recapitalization, which will allow the Company to finance future growth in the business.

Q3 2017 Industrials M&A Update

Q3 2017 Industrials M&A Update

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

GCG Advises Newtex On Its Recent Acquisition

GCG Advises Newtex On Its Recent Acquisition

Latest News

Greenwich Capital Group LLC (“GCG”) is pleased to announce it has successfully advised Newtex Industries, Inc. (“Newtex”) on its acquisition of Thermostatic Industries, Inc. (“Thermostatic”).

GCG Advises American Seating on the Sale of its Architectural Seating Division

GCG Advises American Seating on the Sale of its Architectural Seating Division

Latest News

GCG is pleased to announce its role as the exclusive financial advisor to American Seating Company regarding the sale of its Architectural Seating Division to Irwin Seating Company.

Greenwich Capital Group Advises Control-Tec, LLC On Its Sale To Delphi Automotive (NYSE:DLPH)

Greenwich Capital Group Advises Control-Tec, LLC On Its Sale To Delphi Automotive (NYSE:DLPH)

Latest News

Greenwich Capital Group LLC is pleased to announce the sale of Control-Tec, LLC (“Control-Tec”) to Delphi Automotive PLC (“Delphi”). Greenwich Capital Group advised the shareholders of Control-Tec through the transaction.

Commercial Steel Treating Corporation Partners With HCI Equity Partners

Commercial Steel Treating Corporation Partners With HCI Equity Partners

Latest News

Greenwich Capital Group LLC is pleased to announce that Commercial Steel Treating Corporation and its wholly-owned subsidiary Curtis Metal Finishing Company (together, “CSTC” or the “Company”) has partnered with HCI Equity Partners (“HCI”).

Latest News

GCG is pleased to announce its role as the exclusive financial advisor to Bay Cast, an integrated steel casting and precision machining company based in Bay City, Michigan, on its sale to Auxo Investment Partners.

Latest News

GCG is pleased to announce its role as the exclusive financial advisor to Variation Reduction Solutions, Inc. on its acquisition of Inos Automationssoftware GmbH and Inos Hellas S.A. from Grenzebach Maschinenbau GmbH.

Latest News

GCG is pleased to announce its role as the exclusive financial advisor to the Miller family in the recapitalization of Miller Industries with Tower Arch Capital.

Latest News

Greenwich Capital Group is pleased to announce its role as the exclusive financial advisor to Midwest Glass Fabricators, Inc. on its sale to Oldcastle BuildingEnvelope, Inc.

Latest News

Greenwich Capital Group is pleased to announce its role as the exclusive financial advisor to Woodharbor Molding & Millworks, Inc. on its sale to WF Cabinetry Group, a portfolio company of HCI Equity Partners.

Perspectives

A Rapidly Growing US Semiconductor Industry: Significant Investments in Infrastructure Bolstered by the CHIPS Act

Perspectives

Medical Devices and Equipment: GCG Industry Perspectives in Conjunction with FIME 2023

Industry Update

GCG’s Q1 2023 Industrials Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Perspectives

3D Printing and Additive Manufacturing: GCG Industry Perspectives Following RAPID + TCT 2023

Industry Update

GCG’s Q4 2022 Industrials Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Perspectives

Precision Machining and Metal Forming: A Robust M&A Market for Companies Focused on Aerospace & Defense and Other Mission-Critical Industries

Latest News

Greenwich Capital Group is pleased to announce its role as the exclusive financial advisor to Cameron Tool Corporation on its sale to Tool Tech.

Industry Update

GCG’s Q3 2022 Industrials Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Industry Update

GCG’s Q2 2022 Industrials Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Industry Update

GCG’s Q1 2022 Industrials Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Industry Update

GCG’s Q4 2021 Industrials Industry Update offers a data-driven analysis on transaction volumes and values, activity by sector, and private equity deal flow.

Latest News

Greenwich Capital Group (“GCG”) is pleased to announce its role as the exclusive financial advisor to Princeton Precision Group (“PPG”) on the acquisition of Tampa Bay Machining.

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Latest News

Greenwich Capital Group (“GCG”) is pleased to announce its role as the exclusive financial advisor to SAC Ventures, Inc. and its subsidiaries (the “Company), including Flat Rock Metal, Inc. (“FRM”) and Bar Processing Corporation (“BPC”), on its sale to the Flat Rock Metal and Bar Processing Employee Stock Ownership Plan (“ESOP”).

Latest News

Greenwich Capital Group (“GCG”) is pleased to announce its role as the exclusive financial advisor to Proos Manufacturing, Inc. (“Proos”) on its sale to Westbourne Capital Partners (“WCP”).

Latest News

GCG is pleased to announce its role as an advisor to AJR Filtration on the acquisition of Delta Pure Filtration.

Latest News

GCG is pleased to announce its role as the exclusive financial advisor to HomeFirst Certified Communities ("HomeFirst") on its sale to Green Courte Partners, LLC ("Green Courte").

Latest News

GCG is pleased to announce its role as the exclusive financial advisor to MASONPRO on its sale to Construction Supply Group, a portfolio company of The Sterling Group.

Perspectives

GCG explores the favorable trends that are driving private equity interest in the Aerospace & Defense sector.

Latest News

Greenwich Capital Group (“GCG”) is pleased to announce its role as the exclusive financial advisor to Harper Brush Works (“Harper”), a division of Horizon Global (NYSE: HZN), on its sale to AMES Companies, Inc. (“AMES”), a subsidiary of Griffon Corporation (NYSE:GFF).

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Latest News

GCG is pleased to announce its role as the exclusive financial advisor to Signal Holdings, LLC and its subsidiaries on its recapitalization by Bank of America Merrill Lynch, which will allow the Company to support its continued growth.

Latest News

Greenwich Capital Group is pleased to announce its role advising McKechnie Vehicle Components USA, Inc. on its recapitalization, which will allow the Company to finance future growth in the business.

Industry Update

GCG’s industry updates offer a data-driven analysis on transaction volumes and values, activity by sector and private equity deal flow.

Latest News

Greenwich Capital Group LLC (“GCG”) is pleased to announce it has successfully advised Newtex Industries, Inc. (“Newtex”) on its acquisition of Thermostatic Industries, Inc. (“Thermostatic”).

Latest News

GCG is pleased to announce its role as the exclusive financial advisor to American Seating Company regarding the sale of its Architectural Seating Division to Irwin Seating Company.

Latest News

Greenwich Capital Group LLC is pleased to announce the sale of Control-Tec, LLC (“Control-Tec”) to Delphi Automotive PLC (“Delphi”). Greenwich Capital Group advised the shareholders of Control-Tec through the transaction.

Latest News

Greenwich Capital Group LLC is pleased to announce that Commercial Steel Treating Corporation and its wholly-owned subsidiary Curtis Metal Finishing Company (together, “CSTC” or the “Company”) has partnered with HCI Equity Partners (“HCI”).