GCG Advises on the Recapitalization of Miller Industries with Tower Arch Capital

GCG Advises on the Recapitalization of Miller Industries with Tower Arch Capital

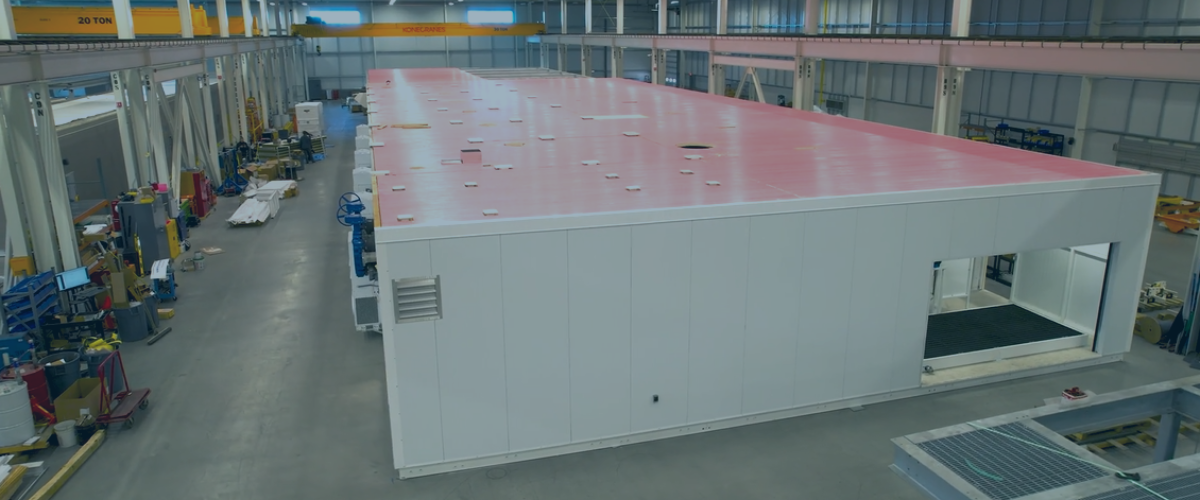

Greenwich Capital Group (“GCG”) is pleased to announce its role as the exclusive financial advisor to the Miller family in the recapitalization of Miller Industries, LLC (“Miller” or the “Company”) with Tower Arch Capital (“Tower Arch” or “TAC”). Miller is a leading designer and manufacturer of highly-engineered modular air handling units, electrical substations, central utility plants, industrial refrigeration systems, and other custom steel fabrication products for the data center, semiconductor, electric vehicle, automotive, and other diversified markets. This transaction adds to GCG’s extensive experience in the industrial infrastructure, engineered equipment, and manufacturing sectors.

Greenwich Capital Group (“GCG”) is pleased to announce its role as the exclusive financial advisor to the Miller family in the recapitalization of Miller Industries, LLC (“Miller” or the “Company”) with Tower Arch Capital (“Tower Arch” or “TAC”). Miller is a leading designer and manufacturer of highly-engineered modular air handling units, electrical substations, central utility plants, industrial refrigeration systems, and other custom steel fabrication products for the data center, semiconductor, electric vehicle, automotive, and other diversified markets. This transaction adds to GCG’s extensive experience in the industrial infrastructure, engineered equipment, and manufacturing sectors.

About Miller

Headquartered in Fenton, MI, Miller was founded in 2014 and is built upon decades of family experience in climate technologies and steel fabrication dating back to the 1980s. Miller’s specialization in modular construction is at the forefront of broad industry trends toward off-site construction and assembly, minimizing time to completion and lowering overall project costs. The Company’s products are critical pieces of infrastructure with significant long-term industry tailwinds supporting the advancement and adoption of its product offerings. For more information about Miller, please visit www.millc.com.

About the Transaction

On August 30, 2024, Tower Arch Capital, in partnership with management, completed a recapitalization with Miller, marking the second platform investment for TAC’s third fund. The transaction strengthens Miller’s existing platform, positioning the Company to accelerate its growth by aggressively pursuing key strategic initiatives, including vertical integration and continued geographic expansion. Miller is an ideal fit with Tower Arch’s strategy of investing in industrial and infrastructure companies with leading market positions, significant growth opportunities, and family-/founder-owned management teams.

“We are very pleased to partner with Tower Arch to support this next phase of our growth and expansion. Miller has quickly grown to become a mission-critical partner to our customers as they build and expand new facilities, and we remain committed to providing exceptional solutions to our customers,” commented Miller Co-CEO Matt Miller.

“We appreciate GCG’s guidance throughout the entire transaction process, which resulted in an outstanding outcome for our family,” added Miller Co-CEO Chad Miller. “Their team’s significant experience and consistent efforts enabled us to identify Tower Arch as the ideal partner for our business going forward. We are excited to embark on the next phase of Miller’s evolution with TAC.”

About GCG’s Role

GCG acted as the exclusive financial advisor to Miller in its transaction with Tower Arch. “Our focus was on finding not just the right strategic fit for our client, but the right cultural fit as well. Tower Arch’s impressive track record, coupled with a shared set of core values, make it an excellent partner for Miller. We look forward to following the Company’s continued success in the coming years alongside its new partner,” said Bob Coury, Managing Director and CEO of GCG.

About TAC

Headquartered in Salt Lake City, UT, Tower Arch Capital is a growth-oriented middle market private equity firm. Tower Arch seeks to partner with high-quality family- and entrepreneur-owned companies to deliver long-term value for their management teams and investors. Tower Arch brings operational, consulting, and financial expertise to companies to help them improve their operations, scale, and grow. For more information, please visit www.towerarch.com.

Related Professionals

Get in Touch

Tell us a little about yourself and we will get in touch as soon as we can.

Back to news articles

Back to news articles