Technology & Services

TECH SPECIALISTS | FORMER OPERATORS | SEASONED ADVISORS

Greenwich Capital Group’s Technology Investment Banking team blends a unique mix of deep sector expertise, C-level operational acumen, bulge-bracket experience, and world-class advisors.

We do so because we are passionate in our belief that our role is to be more than a transaction advisor…we are Client Lifecycle Advisors. We support middle market clients from their infancy, through financings, recapitalizations, acquisitions, strategic planning, industry benchmarking, and eventual exit. We purposefully built the technology team to compile the full range of capabilities required to support each of these phases and associated client challenges.

Having closed over 200 transactions, GCG’s technology team has experience in every meaningful sub-vertical of B2B SaaS and tech-enabled services. As such, we are well-versed in partnering with tech clients to articulate their differentiated solutions to acquirers, targets, and investors.

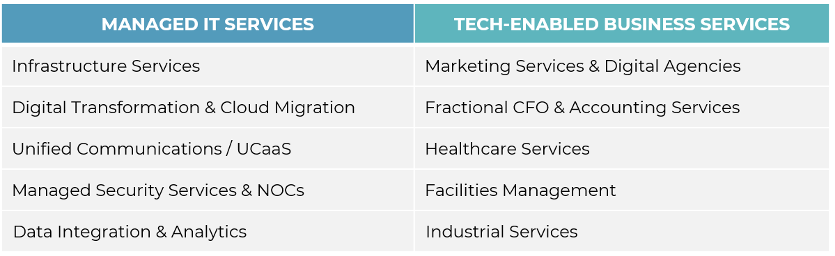

Technology & Services Coverage Areas

Managed IT Services and Tech-Enabled Business Services

B2B Software Coverage

Dedicated Buyside M&A for Middle Market Technology Clients and Their Private Equity Sponsors

As they mature, technology companies reach a point where it becomes increasingly difficult to grow at the same trajectory organically – at which point acquisitions become a necessity. Engaging a sector-focused, buyside M&A advisor to uncover proprietary add-on targets that expand solution breadth, vertical coverage, geographical footprint, domain expertise, and customer demographics is transformational as companies move into the next stage of development. A buyside strategy also has the ability to unlock multiple arbitrage in the eventual exit as synergies are unearthed in the form of scale “step-ups”, higher multiple revenue streams, improved unit economics, growth acceleration, and margin enhancement.

GCG’s Technology & Services team has dedicated buyside M&A resources that are singularly focused on helping clients to define and execute on their inorganic campaigns. We have worked with some of the most successful private equity investors in the technology industry in this capacity, and pride ourselves on having closed more than 70% of these buyside mandates.

Related Professionals

Get in Touch

Tell us a little about yourself and we will get in touch as soon as we can.

Recent Industry Experience

View Details

View Details

View Details

View Details

View Details