Navigating Challenges and Seizing Opportunities in Healthcare Services Private Equity

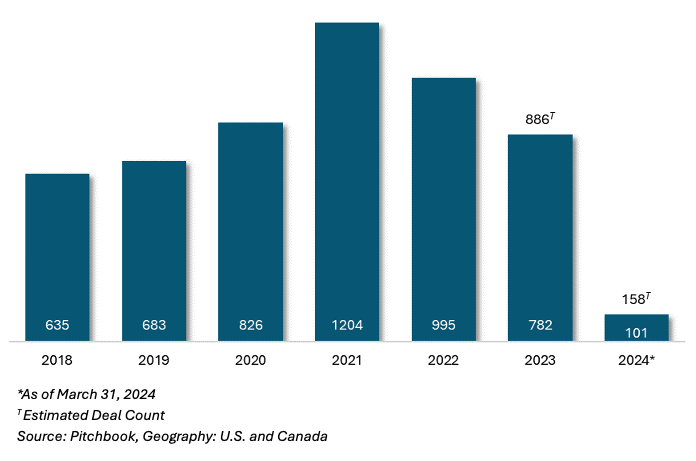

Private equity activity in healthcare services and physician practice management (“PPM”) experienced consistent decline year over year since its peak in 2021, including recently observed lows in Q1 2024 with only 101 transactions recorded, the lowest quarterly deal volumes observed since Q2 2020 (COVID), according to Pitchbook.

Healthcare Services PE Deal Count

Although deal activity has declined from peak 2021, premium assets with strong management teams, specialties with growth profiles / fragmentation and a healthy mix of commercial and private pay attributes will continue to see strong valuations. Macroeconomic tailwinds, including aging population, healthcare consumerism and market fragmentation will continue to drive private equity interest in PPM and healthcare services more broadly.

Factors that have contributed to a pullback in deal activity include:

- Regulatory environment and public perception – Recently announced investigations surrounding the “inquiry of impact of corporate greed in healthcare” by the FTC, DOJ, and DHHS, along with numerous investigations into the impact of private equity in healthcare, have cast a shadow over investments in PPM and healthcare services. It will be critical for private equity investors, physicians, and operators to continue demonstrating the importance of new capital investment into PPM and the benefits of scale and operational expertise inherent in capital availability and consolidation.

- Interest rate environment – Although the interest rate hikes experienced in 2022-23 have subsided, the lending environment for all middle market M&A deals has been more challenging for the last 18 months. Private equity buyers are taking more conservative leverage on deals, but recent activity points to better times ahead, with max debt multiples of 4x to 5x EBITDA observed leverage multiples in several platform acquisitions.

- Pro forma adjustments – With a more conservative lending environment, private equity investors have become more disciplined in reviewing and analyzing pro forma adjustments related to one-time / integration costs, normalized partner compensation, and de novo growth adjustments. Underwriting these adjustments continues to be a challenge for both buyers and sellers but can be overcome by utilizing structured financing, incentives, and earnouts to bridge valuation gaps.

- Integration and synergies – Private equity interest in PPM often hinges on their ability to identify and target physician practices to create scale, implement best practices, and leverage back-office efficiencies to drive value for platform investments. Integrating each practice acquisition into the PPM platform can often be a heavy lift on the organization and, along with cultural, operational, and staffing changes, may be underestimated. Private equity investors that have developed successful playbooks will realize outsized value in their PPM investments and stakeholders relative to their peer funds.

- PPM platform vintages – Many PE-back PPM platforms across various specialties continue to age in their portfolios without a clear path to an exit. Many of these platforms were established in a low interest rate environment, where add-on acquisitions were financed with inexpensive debt and are potentially over-levered relative to the realities of the current market, resulting in suppressed equity values and a reluctance to exit. Ongoing capital markets uncertainty, combined with regulatory and anti-trust scrutiny, may reduce the interest in these assets by other, larger private equity or strategic investors as well. In order for a new crop of private equity investors to enter the PPM sector, legacy holdings must be transacted to demonstrate the effectiveness of the PPM model and the ability to find liquidity from larger funds at maturity.

Although the healthcare services sector has experienced several challenging factors contributing to headwinds for PE investors, certain specialties continue to see interest and activity, including dermatology and med spa, cardiology and vascular, women’s health, and veterinary medicine and ancillary services. Additionally, sellers who seek a significant rollover position with private equity have demonstrated conviction in their businesses and support higher valuations by reducing the debt load and equity capital requirements from private equity investors.

Physicians and operators looking to partner should remain disciplined and identify the right time to ‘go-to-market’ and select a private equity partner that will support their growth objectives and supplement back offices and administration while allowing them to practice medicine and serve patients in a consistent and appropriate manner. Choosing an advisor to support physician and shareholder objectives in identifying the ‘right’ private equity partner, while understanding the interests and behaviors of private equity, will result in successful outcomes for all parties.

Related Professionals

Get in Touch

Tell us a little about yourself and we will get in touch as soon as we can.

Back to news articles

Back to news articles