Key Auto Tech Dealership Trends in 2022

The automotive dealership industry is rapidly transforming due to evolving customer expectations, increased EV sales, technology adoption, supply constraints, and fuel prices. These factors have led to a significant shift in auto dealership trends. Technology has played a critical role in the auto dealership space, spotlighting data analytics, CRM solutions, digital marketing, and information security systems. Increased technology penetration – which rose out of necessity during the pandemic – has now become an integral part of the auto dealership space. These trends are likely to continue well into 2023.

Technology Playing a Bigger Role in Dealerships and Industry M&A

There continues to be an expanding push for technology solutions for the dealerships. The technology is focused on everything from upfront sales, website, and marketing to the service and used car sales departments. Some of these technology initiatives have created significant value for these companies. M&A activity in this sector has been strong, and the transaction multiples for this sector are frequently much higher and more lucrative than the actual dealership multiples.

Fig 1: Notable Technology Transactions in Dealership Space

Source: MergerMarket, Capital IQ, CB Insights

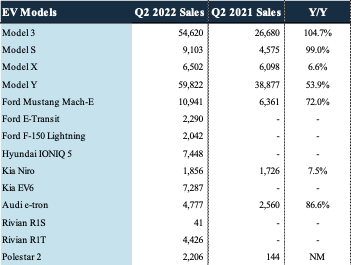

Demand for Electric Vehicles and New Offerings Will Influence Dealerships

With gas prices at a historic high and the continued focus on climate change, the push for electric vehicles has gained traction. Most of the major automakers are launching new products which will be electric only. While dealers might sell a similar number of cars, an increasing number of EVs will significantly impact service. Electric vehicles have a few moving parts, no need for fluids (e.g., gas, oil, transmission, radiator), and are projected to last much longer than internal combustion engines. The core service will be focusing on tires and batteries. Dealers might start to lose a lucrative part of their dealership profitability.

Fig 2: Sampling of EV Sales by Select Models

Source: Kelley Blue Book

Spotlight on Data Access and Security

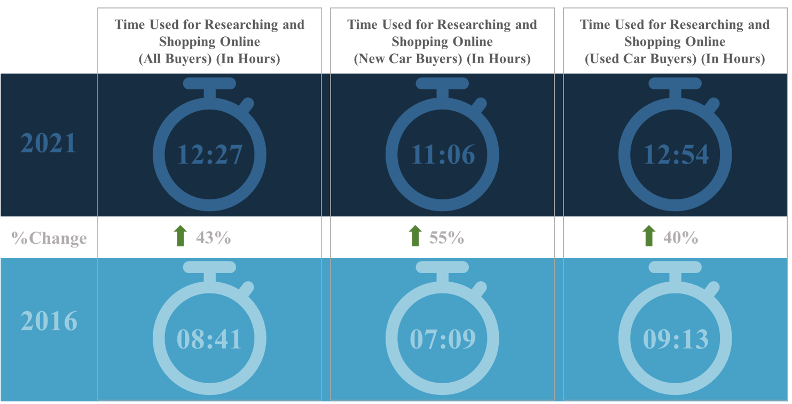

With growing online customer interactions, a holistic data-driven approach to capturing changing customer preferences will continue gaining traction. Dealerships will continue leveraging advanced analytical data, insights, and identity graphs to strengthen their brand and gain a competitive advantage.

With more customers expecting personalized interactions with brands, understanding their demographics, motivation, preferences, behavior, and past interactions becomes critical for a customer-centric experience. However, stricter privacy regulations in California and other US states limit businesses’ ability to access and use third-party data. Therefore, dealerships must work on new strategies to extract first-party data from their customers.

Fig 3: Customer Spending More Time Researching and Shopping Vehicles Online (2021 vs. 2016)

Source: Cox Automotive

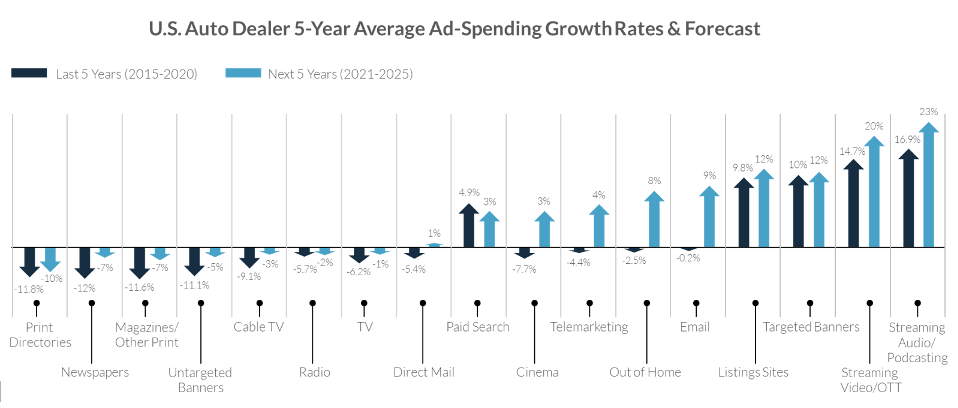

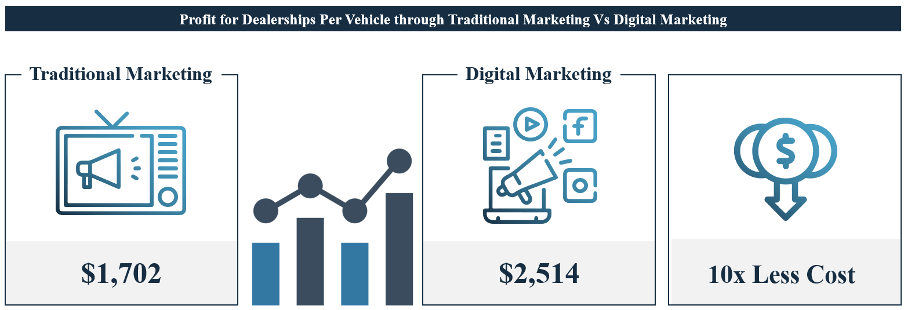

Increasing Demand for Advanced CRM and Digital Marketing Solutions

The pandemic transformed marketing from old-line media to digital marketing. The benefits for dealerships are significant such as helping them increase customer base, improve customer experience, and generate higher margins on sales and after-sales.

The entry of DMS providers is intensifying the competition in the automotive CRM landscape. DMS’ are looking to enter a fragmented market by acquiring small CRM vendors, leading to a rise in M&A activity in the space. In addition, there is a shift toward cloud-based CRM solutions due to advantages such as lower capital investment and flexible payment options. These benefits are especially appealing for small and medium-sized dealerships offering advanced features, helping them become more competitive.

Fig 4a: Dealers Embracing Digital Media Channels

Source: Borrel Associates, Next TV

Fig 4b: Digital Marketing Leads to Increased Profits and Lower Costs

Source: DealerSocket

Dealerships to Ramp Up Investments in Data Analytics

Data analysis tools can help dealerships maximize their efficiency, revenues, and profits by measuring performance and navigating inventory-related challenges, ultimately adding to the bottom line. The business insights revealed by big data not only help dealers offer relevant deals and promotions but also add to the cost-effectiveness of the dealership.

There is a growing trend among dealers to leverage big data to collect, process, and get insights such as market demand, car-buying patterns, vehicle supply, and sales history. For instance, data analytics can help dealerships identify strong demand for a particular vehicle and formulate targeted marketing strategies.

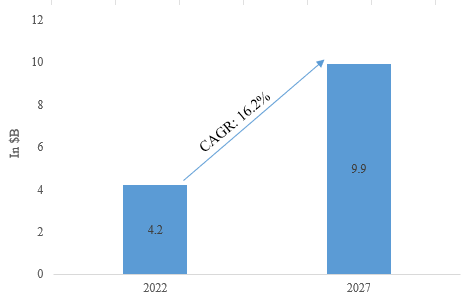

Fig 5: Growing Big Data Market in the Automotive Industry

Source: Mordor Intelligence

Adoption of GPS, Geofencing Software, and Vehicle Recovery Tools to Remain Strong

The adoption of GPS and geofencing software continues to gain traction among dealerships. These solutions enable significant operational efficiencies and cost savings, including improved safety, automated real-time alerts, better inventory management, and reduced insurance cost.

The combination of GPS, geofencing, and related security features, allows dealers to build a near-impenetrable inventory management system. Further, geofencing software comes with instant messaging and in-built task management capabilities that help improve employee communication.

Fig 6: GPS Solutions Offer Significant Advantages for Dealerships

Source: PassTime

Agency Model to Gain Traction

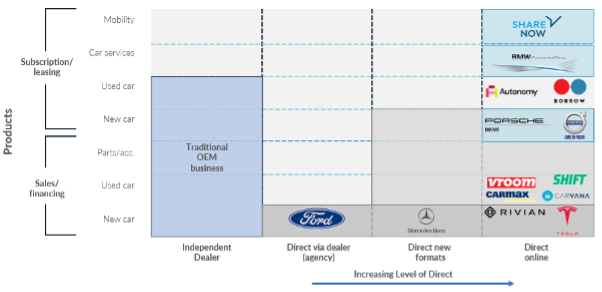

As automotive retail is evolving, various US automakers, including Ford, are mulling the agency model to offer customers cross-channel price transparency. While such a model where a customer can directly order from the automakers has already arrived in other parts of the world, including Europe, the US automakers are yet to adopt it on a large scale except Tesla, which works on a direct-to-customer sales model. Traditional automakers such as Daimler and Volvo unveiled their European direct sales plan. Similarly, Honda and Mercedes-Benz also shifted to the D2C model in Australia.

Technology is playing a considerable role in the growing adoption of the D2C model by the auto industry. A holistic set of digital capabilities such as big data analytics, advanced digital platforms, connected CRM systems, and inventory and sales management software are critical to the success of the D2C model. Companies like Digital Motors have leveraged these technologies and are projecting themselves as online sales platforms for legacy dealership businesses and OEMs.

Fig 7: Legacy Model Vs. Multiple Levels of Direct Sales

Note: (1) Mercedes Benz has adopted the D2C model in select markets; (2) Direct New Formats comprise companies scaling back traditional brick-and-mortar retail networks in favor of new formats such as flagship and pop-up stores; (3) Ford plans to adopt the agency model with their dealers selling at MSRP for a fixed commission. Source: Arthur D. Little

The benefits of the agency model to the automakers are significant. They can capture additional margin on vehicle sales, control pricing, and the sale experience. While the benefits of the agency model are manifold for automakers, it is a threat to dealerships. While the threat could be significant, dealers could focus on higher profit business segments such as services and used car sales. Moreover, the new model comes with a lower cost structure and lesser market-facing risk for the dealers. Either way, it is another significant change on the horizon for dealers that will have winners for those who can capture the benefits of this potential change.

Related Professionals

Get in Touch

Tell us a little about yourself and we will get in touch as soon as we can.

Back to news articles

Back to news articles