Current Trends Impacting Steel and the Overall Metals Industry

The current economic environment has driven conflicting impacts on the steel and metals industry. Macro-economic and geo-political factors have had a significant impact on the industry. Key factors include unprecedented inflation, supply chain disruptions, the Russia/Ukraine war, accelerating demand, and the continued impact of COVID. Each of these are causing changes to the steel and metals market. Some of our key findings are below:

How the Current Economic Factors will Impact Middle Market M&A

2021 was a transformational year for the US steel industry, which saw record profits, new investments, and strategic M&A activity gaining pace. The industry, though, is facing some headwinds in 2022. While supply concerns amid the Russia-Ukraine war pushed the prices up, the initial shock and the price surge from the war have dissipated. The geopolitical risks stemming from the war, supply chain disruption, and recessionary fears could put some pressure on the strong demand currently in the market.

Despite this, the demand outlook for the industry remains healthy with construction, automotive, and aerospace sectors expected to be key demand drivers. Going ahead, a positive demand outlook is likely to support strong valuations for steel companies. All major steel companies, which reported results recently, saw strong business in the second quarter, due to healthy order books, affirming that the industry is in good shape. This strong performance within the industry provides solid support for increased M&A activity in the space, with more deals likely on the horizon.

Demand to Remain Healthy and Support Strong Pricing

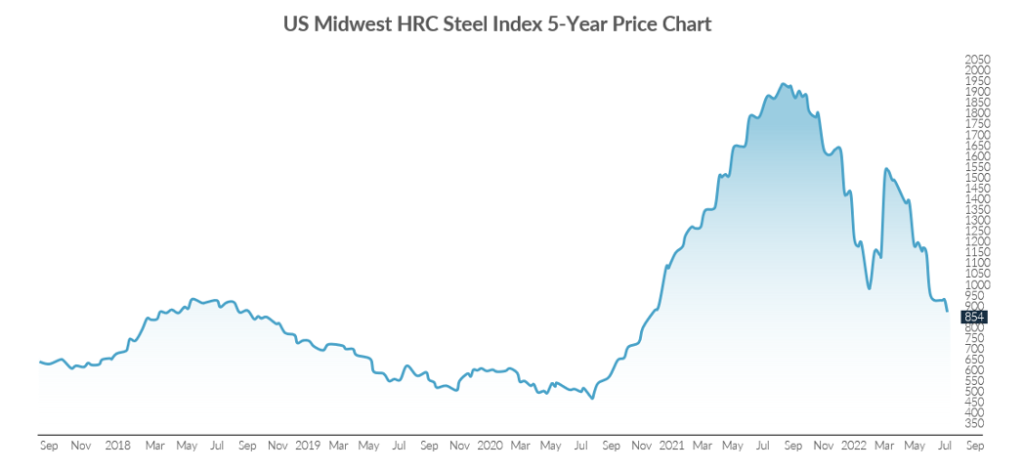

In the near term, strong supply/demand dynamics and relatively high raw material costs are expected to provide a stable support level for steel prices. After remaining inflated between March to June due to war, hot rolled coil, cold rolled coil, and hot dipped galvanized prices have dropped below their early March level.

Increased infrastructure spending and activity in automotive sectors are key drivers for steel companies, fueling optimism and supporting a bullish outlook. The demand from these sectors coupled with the ongoing demand from non-residential projects such as warehouses, data centers, and commercial buildings, has been driving demand in the US for steel. To keep up, several major US steel companies are embarking on new investments in new mills and ancillary services.

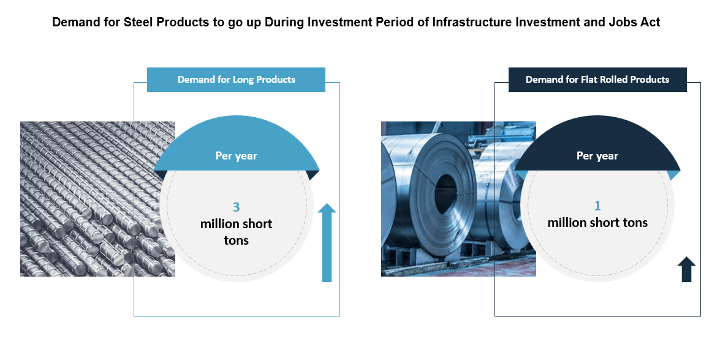

Steel remains crucial for the US government’s infrastructure push as well as energy transition plans. President Biden’s $1.2 trillion Infrastructure Investment and Jobs Act is expected to prove to be a big boost to the US steel companies. This is expected to uplift the demand for long products such as rebar and wire rods, with billions of dollars allocated for traditional steel-consuming structures such as office buildings and other non-residential construction. As per estimates from KeyBanc Capital Markets, the demand for long products is expected to increase by up to 3mn short tons per year while that for flat-rolled is likely to go up by 1mn short tons per year during the investment period.

Fig 1: Infrastructure Push to Elevate Demand for Long and Flat Rolled Products

Source: KeyBanc Capital Markets

Additionally, the bill is also likely to spur EV adoption by unlocking billions of dollars for EV infrastructure. An accelerated EV adoption and subsequent demand for the steel augurs well for companies such as Cleveland Cliffs which supplied more than 50% of the steel for the 13 million vehicles produced in North America in 2021. As the chip shortage eases and auto production ramps up, the demand is expected to strengthen further.

Similarly, the broader automotive industry will also benefit from improved semiconductor availability, pushing demand for steel higher. Between 2015 and 2020, over 17 million new cars were manufactured in North America every year, which has come down to 13 million in the last two years, down 24%, despite strong demand for vehicles. This shortfall in supply will keep the industry busy for the foreseeable future.

Fig 2: Despite Recent Dip, Steel Prices Remains Above Pre-Pandemic Levels

Source: Trading View

Positive Pricing and Demand Outlook Supports Strong Valuations

Despite the macroeconomic uncertainty in the first half of 2022, the steel industry has outperformed the broader market year to date. A comparison of the NYSE Arca Steel Index with the S&P 500 shows that overall steel companies have fared better than the broader market. The industry has offered a return of (1.03)% YTD against the S&P 500’s corresponding return of roughly (13.58)%. Also, companies in the metal services sector have offered a mean return of 2.71% while those in engineered metals offered 10.76%, significantly outperforming S&P 500. Despite some macroeconomic headwinds, the overall demand fundamentals for steel remain solid and point to strong valuations and healthy balance sheets for US steel companies.

Fig 3: Steel Industry Outperforms S&P 500

Source: Google Finance

Though valuations have come down slightly from 2021 levels, they remain relatively healthy. As of August 5, companies in metal services had 1-year forward EV/EBITDA multiple trading in the mid-to-high single-digit range whereas engineered products and alloy companies were even trading in the high single to low double-digit range.

Challenges Ahead

The commodity industries are notoriously cyclical, with steel being no exception. While inflationary and recessionary fears were already looming large, the Russia-Ukraine war came as an unprecedented shock for the industry, posing significant long-term implications. The war left 90% of Ukraine’s steel capacity non-operational which affected supply chains. Also, the Russian warships blocking of Black Sea impacted trade.

Even though the initial shock from the war has receded, supply disruption remains an issue. The two countries accounted for around 62% of American pig iron imports last year. Even if the Russia-Ukraine war ends in 2022, the sanctions on Russia are unlikely to go away soon. This will mean a possible readjustment in trade flows of commodities including steel.

In its short-range outlook for 2022 and 2023, the apex industry body World Steel Association cut its projections for growth in steel demand to 0.4% in 2022 to reach 1,840.2 Mt and 2.2% in 2023 to reach 1,881.4 Mt. The projections remain relatively healthier for advanced economies including the EU and US. Additionally, the continued push by central banks to restrict the growth of inflation could threaten the overall economic forecast in the US and globally. These are key factors to watch as there are ongoing pressures for the industry that will play out over the coming 12 to 24 months.

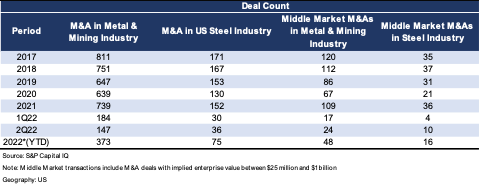

Middle Market M&A

The M&A deal activity in the US steel industry is coming off of a very strong 2021. So far, 2022 has remained strong but not at the same levels as 2021. In 1H22, the industry saw 66 deals, a slight dip from the same period last year.

Fig 4: M&A Activity in US Steel Sector

To vertically integrate and fortify supply chains, steelmakers and recyclers have been actively making deals in the scrap industry. Steel mills also see downstream acquisitions as a great opportunity to grow as it offers them benefits like improved furnace efficiency, closeness to the end user, and margin enhancement. With companies sitting on large pools of capital, competition for assets might get intensified. To improve margins and offset volatility, service centers are also expected to acquire companies with high levels of value-added processing.

Based on all of these factors, we believe that 2022 will continue to strengthen for middle market M&A in this sector and 2023 should be a strong year. That said, we are keeping a close eye on the economic impact of recent rate hikes and other negative constraints to the overall economy.

Get in Touch

Tell us a little about yourself and we will get in touch as soon as we can.

Back to news articles

Back to news articles